That’s a very bad heading but I could not think of anything else .

What is evil — “ Evil is Knowing Better but doing worse “

Mr. Daniel Kahneman(the nobel winner) is one the most amazing thinkers of modern era who has just completely changed the way we look at the world and the decisions taken by people in the world. His brilliant book(http://www.amazon.com/Thinking-Fast-Slow-Daniel-Kahneman/dp/0374275637 ) is a 20 times read. You can just keep reading again and again and again – discovering new things every time you do that. It makes you understand why probably you took a decision when ideally/rationally you should not have done so. So why the critique post ??

Well having read the brilliant book Thinking Fast and Slow by Mr. Daniel Kahneman I noticed something strange in every single question he had ever asked for framing his theories mostly related to monetary gambles/chance/risk taking . They will NOT apply completely to the thousands of Bankers, Traders, Lenders, Insurance Sellers(who are or should I say were too big) –who are taking decision under risk . The reason the theories will NOT apply is NOT because decisions are complex or theories completely wrong or they are using System 1 instead of System 2 but because the crucial elements (situations/conditions) are almost always neglected in almost all questionnaires for any psychology/logic tests undertaken by any researcher.

I searched for various of his articles and the references he himself used for writing those and I could not find the most important factors which affect decision making under risk in real life organization/situation .

The choice of picking a decision using rational calculations or System 1(intuitive) based on prospect theory or whatever is secondary to the conditions surrounding the decision making. The conditions surrounding decision making are NEVER extraneous or too unimportant in real life.

This analysis will look at the financial risk taking while showing that prospect theory(http://en.wikipedia.org/wiki/Prospect_theory) cannot explain the decision making in financial world today when complete picture of conditions which leads to reckless risk taking is taken into account i.e. the incentives (bonuses), Superiors’ orders, managing other peoples’ money, too big to fail and implicit guarantee from all Central Banks around the world that you will be saved even if you completely screw up (the whole firm or consequently even the economy).

I would love if Mr. Daniel Kahneman applies all his theories of decision making to the bankers and financial industry as we know today to show how effectively it predicts the actual actions of these Lords of Finance. I am sure the theories cannot be applied to decision making of bankers which have brought terrible misery to millions around the world and amazing riches to bankers and financial institutions.(if you do not believe this stop reading!!)

I argue that what happens in REAL world more than 99% of the time when real people (almost all in some sort of organizational set up) are taking real decisions in organizations which can be observed by anybody is not explainable completely by theories like prospect/certainty effect/loss aversion/utility/System 1 or 2, etc.

I am not a professor who can catch 50 students and give them a sheet of paper with 5 logic questions (each with 2 choices) and then extrapolate them to real life decision making. I will ask the same questions which have been asked in the book Thinking Fast and Slow at the end of the write up. The only difference will be – I will use context/surrounding events before anyone has to decide which option to choose. The responses I am sure will be exactly normal as what happens in real life but the responses will violate most of the existing theories regarding decision making under risk.

My Hope to Explain Real Life Decisions taken under Risk

My hope is to explain the way real life choices are taken by individuals who have the maximum effect on the society (like bankers). Unfortunately when I look at the decisions taken by individuals under risk (most of them in a organizational setting) then the System 1 or System 2 or prospect theory or certainty effect DOES NOT seem to be able to explain even 20% of the decisions actually taken. Almost all of the crucial decisions impacting Trillions of Dollars and Millions of human beings cannot be explained using prospect, certainty, possibility or loss aversion effects or expected utility theories. While someone may actually say that whatever I have written is basically behavioral finance/economics but I would disagree because it is not just about behavior but thinking-action and the disconnect between what is expected based on current theories to what actually happens in reality.

Nowhere would I say that any of the theories are wrong. It is just that what you observe in real life cannot be explained using the theories available either by Bernoulli(http://en.wikipedia.org/wiki/Expected_utility_hypothesis ) or by Mr. Kahneman. I am not aware of other theories which may explain the actual decisions but what I will try to do is use the already available research/psychology theories (standing on the shoulders of other giants—wink– rather than trying to re-invent the wheel) and try to relate them to what I have observed in last 15-30 years in financial industry. The responses to choices people make are inconsistent with rational choice or loss aversion or prospect theory or certainty affect and other theories which are in existence.

Mr. Kahneman proposes correctly – after framing of questions that decision-makers, prior to evaluating the prospects, perform an editing operation that collects similar outcomes and adds their probabilities. [i] After that they actually evaluate the prospects using rational choice. This is really helpful when individuals (who are NOT in any organization setting) are taking decision. But it fails when we try to extrapolate them to financial institutions of this world.

What I propose is this(related to decision makers in fin institutions) – Even before editing operation or evaluation of prospects decision makers ALWAYS use their System 3 to understand 4-5 basic facts/conditions which surround almost every decision making, more so in finance.

These can be briefly summed up as – Superior Instructions , Incentives and Threats, Managing other people’s money , Too Big to Fail – Guarantee from Central Banks/Govt (aka privatizing the gains and Socializing the losses) that you will be saved no matter what you do.

I hope some real academics pick up something from my writings to make a more comprehensive theory of decision making under risk which can be applied to real life financial institution without just using words like moral hazard or short term thinking.

(wherever I have written Page Number or P- XYZ it refers to page number of the Book Thinking Fast and Slow)

Arguments against Loss Aversion when applied to Bankers and Money Managers

Loss aversion (http://en.wikipedia.org/wiki/Loss_aversion) will apply only to the individuals whose own money is at risk. It is almost useless to apply loss aversion theory on Thousands of bankers(including Central Bankers) and money managers who do NOT risk their own money but instead manage/move other people’s money. And even in worst case scenario will not lose something which they already have but rather they may not get something which they may have got .

Loss aversion says that suggests that the displeasure of losing a sum of money exceeds the pleasure of winning the same amount. True when money from your own pocket is on the line.

But what if this is not the loss from your pocket/bank account?? What if winning the bet means you will surely pocket bonus but losing the bet will NOT decrease your already huge fixed salary/upfront commission??Losing the bet may make you to get lower bonus. Will the loss aversion principle still apply with the same accuracy?? Does the banker feel same pain as you feel when both lose money? Does the banker or money manager say/feel – OOOOhhh losing a $billion dollar was so painful but winning a $billion was OK??

Of course not . If you are managing someone else’s money then Loss Aversion does not apply completely . Infact completely something like gain fondness is in work while managing other people’s money . Bankers and money managers jump up and down and will/do take crazy risks with other people’s money. No Loss aversion if its not your money . SIMPLE .

Arguments against Certainty Effect

From his book — “Demonstrate that outcomes which are obtained with certainty are overweighed relative to uncertain outcomes. In the positive domain, the certainty effect contributes to a risk averse preference for a sure gain over a larger gain that is merely probable.

In the negative domain, the same effect leads to a risk seeking preference for a loss that is merely probable over a smaller loss that is certain. The same psychological principle-the overweighting of certainty-favors risk aversion in the domain of gains and risk seeking in the domain of losses.”

http://en.wikipedia.org/wiki/Certainty_effect

This is surely in true negative domain because most fin industry do take risk in that way . But I am not sure if it is correct in positive domain .

What is a sure gain for a bank ?? (borrow at 3% ie deposits and lend at 6% , right ?? You are certain to make money this way . (http://en.wikipedia.org/wiki/3-6-3_Rule ) heck ya bankers indeed used to do this.

Try telling 3-6-3 rule to Jamie Dimon and you will have a proof that certainty effect cannot work completely in real life organizational setting when these factors are taken into account .

Don’t you think that 3-6-3 rule is almost certain and other trading, derivatives gains etc are merely probable ?

Don’t you think that exactly opposite happens with bankers where in positive domain they go for more risk taking for gains which are mrerely probable rather than going for sure gain which is lower ?

If answer to any of above question is yes Certainty effect is obviously not correct when applied to bankers .

Then why do you think all banks keep on doing all kinds of trading, derivative activity to generate their profits which are much more risky and merely probable rather than just do normal banking which is almost a sure gain but lower gain?

It is because certainty effect completely fails when conditions surrounding the decision making are taken into consideration . People use System 3 which goes against certainty effect.

Arguments against Possibility Effect

Page 303- Because of the possibility effect, we tend to overweight small risks and are willing to pay far more than expected value to eliminate them altogether. The psychological difference between a 95% risk of disaster and the certainty of disaster appears to be even greater the sliver of hope that everything could still be okay looms very large. Overweighting of small probabilities increases the attractiveness of both gambles and insurance policies.

The conclusion is straightforward: the decision weights that people assign to outcomes are not identical to the probabilities of these outcomes, contrary to the expectation principle. Improbable outcomes are overweighted—this is the possibility effect.

p-303

The large impact of 0 5% illustrates the possibility effect, which causes highly unlikely outcomes to be weighted disproportionately more than they “deserve.”

Well if someone in 2005-06 said Don’t you think that housing prices might go down ? I mean you are AIG who is selling insurance , CDS of more than $200 billion(they got bailed out by getting something around that $+/-20 billion) betting primarily on single assumption that Housing prices will not go down all at once . The probability of house prices going down was surely not 0. It was miniscule but not ZERO . So possibility effect says – improbable outcome (house prices going down) should be overweighed.

How many people or institutions do you know paid too much money to eliminate this miniscule probability of house price decline ?? I know— don’t use the brilliant book “ The Big Short http://www.amazon.com/The-Big-Short-Doomsday-Machine/dp/0393072231 to rattle off the names.

I mean this is called as Mr. Daniel has put – theory induced blindness. Possibility effect is completely proven to be wrong when put in real life situation where the factors which are surrounding decision making are neglected.

Here are few examples :

- Rating agencies just did not have models where they could input house price declines. Didn’t they use System 2 while rating almost trillions of dollars worth mortgage and bonds most of which turned from AAA to CCC within a span of 3 years.

- Could you as a business man selling insurance have stood up in say 2006 and said – Hey according to possibility effect you should pay too much money to protect yourself from house price decline. Hey Mr. Lehman Bank why don’t you buy a insurance I am selling and its priced at 10 times than what AIG is selling because I have read Thinking Fast and Slow.

In fact possibility effect is completely turned on the head (sorry to say completely wrong) when applied to insurance selling by AIG and billions of CDS selling by every single financial institution. They priced the insurance for a low probability event TOO LOW . People(99.99% of them) actually completely sidelined the small risk of house price decline. Everyone except some really smart guys. Go read Big Short. Possibility effect says complete opposite. It says people should overweight the small chance of disaster .

Ok so do you differ on what disaster means ?? Well you just have to have been through 2007-09 to know what a disaster really means . If people did completely opposite to what possibility effect says they should do why is there no paper written on the erroneous possibility effect?? I could not find anything which even remotely tries to relate possibility effect to any financial disaster. If the possibility effect cannot be applied on the financial organizations it should be made clear that — Please apply possibility effect only when individuals are making decisions which concern only them and there are no context/situation/conditions surrounding the decision making – ie decision making is being done in a complete vacuum . Then Possibility effect is fine.

Else please go through these factors which are a must when you try to explain why every body completely neglected a small probability event and nobody was prepared to pay even a penny to insure against a small probability of house decline. You can easily sequentially decipher and relate to the decision making by rating agencies, bankers and insurance companies.

Well I am looking at the rear view mirror with a 20/20 hindsight right?? Here are some really low probability risks and I would ask you to answer some questions:

- Japan defaulting on its bonds. (http://kylebassblog.blogspot.com/ )

- US govt defaulting on its bonds

- US dollar replaced as the world’s reserve currency.(remember pound was till late 60’s)

- US govt confiscating Gold and gold prices jumping stratospherically.

- You have life insurance and motor insurance but have you paid any thought to having some kind of portfolio insurance for the money/stocks/bonds you have against a calamitous decline ?

All these are NON ZERO probability events. Do you think buying protection is cheap (because no takers) or is expensive (too much demand)? Do you think people are overweighting this miniscule chance of the above events and paying exorbitant prices for buying insurance against them? Do you think the insurance companies are pricing protection policies against the above elements at a very high relative level ?

If you will use certainty effect and possibility effect you go completely opposite to what is happening here in real life. Use this method instead .

All this is rather obvious, isn’t it ? You can easily imagine Mr. Kahneman to construct similar real life examples and trying to say that well these are cases when Possibility effect and certainty effect does not work i.e. real world big organizational based cases. But for some reasons he didn’t.

P- 268 If you come upon an observation that does not seem to fit the model, you assume that there must be a perfectly good explanation that you are somehow missing. You give the theory the benefit of the doubt, trusting the community of experts who have accepted it.

Well I don’t do that.

Importance of Conditions/Situations in Decision Making

Conditions/Situations surrounding a financial decision making are more important factor to determine the decision making under risk than the actual evaluation of choice. Ignoring situational factors in any decision making theories is next to ridiculous. Most economists who do not want situational factors to come in their typical questionnaire type experiments and hence cannot explain how most real life decisions under risk in this world are taken will say – “That can happen in practice but never in theory “.

Daniel Kahneman has brilliantly put in his book Thinking Fast and Slow and various papers[ii] that in decision making there are two phases in the choice process: a phase of framing and editing, followed by a phase of valuation (Kahneman and Tversky 1979). The first phase consists of a preliminary analysis of the decision problem, which frames the effective acts, contingencies, and outcomes. Framing is controlled by the manner in which the choice problem is presented as well as by norms, habits, and expectancies of the decision maker. Additional operations that are performed prior to evaluation include cancellation of common components and the elimination of options that are seen to be dominated by others. In the second phase, the framed prospects are evaluated, and the prospect of highest value is selected.

All of above is fine except when applied in real life when people are taking decisions in organizations.

Human beings decision making process (in absence of these factors) will always follow what Mr Daniel has explained in his book brilliantly. Unfortunately in real life rarely is decision making choice presented to a person without these factors .

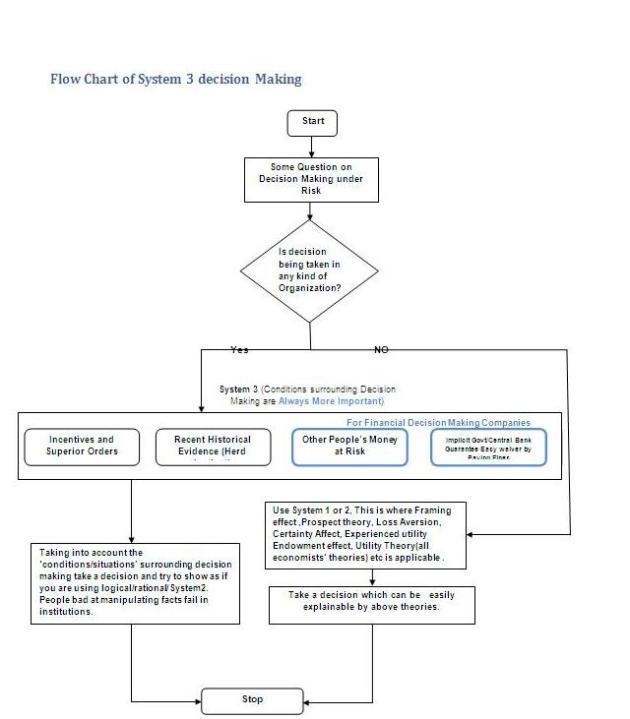

Flow Chart of System 3 decision Making

Proposal of System 3

System 1 and System 2 are very good at explaining almost all the thinking and consequent behaviors shown by human beings.

In short System 1 is good at making quick intuitive everyday decisions where you do not have to really stop what you are doing and think. Rather the answer comes just naturally/quickly (though that does not mean it would be correct).

Typical decisions taken by System 1 – a experienced driver navigating a busy street.

System 2 is much deeper level of thought like multiplying 17×34 .

Best explanations provided here http://en.wikipedia.org/wiki/Dual_process_theory.

Unfortunately vast majority of crucial decisions in this world related to at least financial matters do NOT come under either System 1 or System 2 entirely. I will give lots of examples later in brief of decisions related to financial industry which prove that System 1 and System 2 are not the comprehensive theories which explain what happens in real world when people choose to make decisions.

I love this part from Mr Daniel’s Book – P-306 We took on the task of developing a psychological theory that would describe the choices people make, regardless of whether they are rational.

In the same way I propose that crucial financial decisions (by people in fin organizations) point out to some other System of decision making which is more dominant/important than System 1 and System 2 —ie System 3 .

Existence/Use of System 3 by human beings can be explained when the conditions surrounding a decision making become more important than the framing of choices or of actually evaluating the decision/choices.

In the following part of my write up most examples I will give will revolve around financial industries decision making of late 21st century.

If you as an investor can find out using my above factors/flowchart/conditions which banks/investors are using currently to make decisions and find out that they may be doing mistakes. Then you can take opposite view and outperform. Here is my favorite ‘mentor’ Howard Marks on Mistakes .

http://oaktreecapital.com/MemoTree/It%27s%20All%20a%20Big%20Mistake_06_20_12.pdf

But it requires the investors to understand what is going through with other guys at big banks and completely independent thinking from the crowd.

Factors Influencing Thinking and Decision Making Under Risk

For financial decision making particularly by bankers, traders, insurance sellers (like CDS sellers), fund managers who handle other people’s money and have incentives most of the questions put forth in the book regarding financial losses and gains MUST be preceded with at least these 4 conditions(not necessarily in order):

- Incentives and Superior Orders: Your incentive/bonus is almost completely dependent on you taking the gamble (and winning of course just as so many around you have been recently doing with ease) and you also have been directed by your seniors (a.k.a. superior orders plea) to take the gamble though you can fight back , look lonely/stupid in short term and choose other option.

- Recent Historical Evidence (Herd Instinct) ,Behaving same way as others previously have done and got away with : For the last 2-5 years people (colleagues who have made millions and have been promoted ) and your competitors have been choosing alternative X(which is gamble ,neither a sure thing nor a 98%+ probability event) have actually won and made tons of money, got lot of power, bought big houses, fast cars , beautiful girlfriends/wives and traveled around the world. If you become a banker you have full freedom to screw your clients just as others before you have done consistently and got away with huge bonuses.

- Other People’s Money at Risk: You are not putting your own hard earned money at risk but putting other people’s money at risk. The rewards will be yours and losses will be borne by someone other than you. You can never have a negative bonus but only reduced even if you completely blow up OPM (other people’s money).

- Implicit Govt/Central Bank Guarantee and Easy waiver by Paying Fines: If the whole firm blows up or even economy blows up Central Banks will print money and Save you just as they have previously saved big banks and even hedge funds like LTCM if you are too big to fail. Or if you indeed are caught you can settle by neither admitting nor denying wrongdoing.

Only after all these 4 conditions are specified the normal questionnaire with an option X and other options should follow to test the rational decision making of individuals who are working in financial services industry(even in other industries or public life). Some cases would seem just as moral hazard as an already existing theory for explanation of a lot of decisions I will explain but moral hazard does not take into account Superior Orders . And any case I have yet to see a theory which explains decision making which gels well with decision making under risk and combine it with moral hazard and System 1 and System 2 kind of thinking .

Here are my reasons for putting each of these 4 conditions for any model which seeks to understand decision making under risk.

Whenever a I say a person in Financial Industry it should indicate that I Want to collectively point out to fllowing people – bankers, traders, money managers, lenders ,Insurance Sellers , Analysts, Economists(directly involved with Wall Street).

Incentives and Superior Orders

The most important factor which is taken into account while making a financial decision by a person in financial industry is Incentive and Superior Order . The use of brain, knowledge , experience , rational thinking or intuition etc all come at a second place when crucial and critical decisions are made.

The first consideration when following people get following choices is how will their bonus/salary get affected and what direction has been given the by his superior . The decision to choose an option is almost already taken based on incentives and Superior Orders. The people just have to justify somehow why they chose X over Y trying to look as logical/rational as possible. :

- A Banker gets a loan proposal to approve or disprove a loan of a No income No job homeless guy in 2006.

- Money Manager gets an opportunity to choose between a McDonalds stock or a CDO squared.

- Insurance Seller like AIG decides to insure against default by AAA rated subprime bond by selling a CDS .

- Analysts decide to put a buy rating for Nasdaq stocks when P/E was 150+.

- Economists/Professors try to predict the future macro or micro events before or after crisis .

This discussion is not about trying to predict manias/bubbles and make money or avoid losing money because I have benefit of hindsight and the people did not have it. This is about something like a System 3 in human brain which takes decisions(lot of times completely irrational) when incentives and Superior Orders are combined together to make a powerful force which almost always shuts the System 1 and/or System 2 easily in almost all people involved.

Superior Orders and its Importance in Financial Decision Making

The decision making under risk should ideally be using System 2 and use rational/objective reasoning to arrive based on available facts. Unfortunately that happens in theory or really less number of times in practice. Most of the times any decision making under risk put forth in front of a person in financial industry comes implicitly with a directive from Superior as to what choice should be taken before the person in charge has had a chance to use his rational/knowledge/experience to objectively take a decision on it.

I will try to explain this with the famous Milgram experiments ( a must read )http://en.wikipedia.org/wiki/Milgram_experiment whereby ordinary people administered life threatening shocks and pain to other people just because they were in an experiment and wanted to please the experimenter by obedience to his orders. I will NOT explain the exact experiement but anyone can read about it by googling it.

I will use the material from http://myclass.peelschools.org/sec/12/28291/Homework/Milgram%20-%20perils%20of%20obediance.pdf and try to relate to kind of decision making which has happened in financial industry over the years and try to show why System 1 and System 2 thinking are inadequate/incomplete when applied with Milgram’s findings and why a System 3 actually works in these cases when a Superior has ordered something.

Assumption- Imagine that instead of choosing to give shocks to the ‘learner’, in real financial world the choice for different people were following – giving a loan to absolutely derelict borrower with no income and no jobs , rating CCC group of subprime bonds as AAA , analysts putting buy rating on a stock with no earnings at a valuation which is laughable by any stretch of imagination during IT boom, choosing a CDO squared asset class to invest retirees pension fund money ,etc or to back out .

From Milgram’s experiement:

“Many of the people were in some sense against what they did to the learner, and many protested even while they obeyed. Some were totally convinced of the wrongness of their actions but could not bring themselves to make an open break with authority. They often derived satisfaction from their thoughts and felt that — within themselves, at least — they had been on the side of the angels. “

In other words perfectly rational and smart people abdicate their will to make rational, intelligent and objective choices and thus their autonomy (and System 2) when faced with a Superior Order situation. They then use System 3 to take decisions.

Relating Superior Orders to actions of Subprime Loan Officers

I will say many people in banks who approved the crap loans to no income people knowing fully well that the loan just cannot be paid out in any circumstance, did what people did in the experiment. The loan approvers who did credit checks or risk management teams who approved the kind of subprime loans almost surely knew what would happen but they could NOT say NO when their superiors told them to approve the loans . They had to use their System 3 of brain to do things like Robo Signing, incomplete document based loans, loans to derelict people , etc . They would have derived satisfaction from their thoughts using System 3 and felt : within themselves at least they are giving a person a place to live . Even if a loan officer was totally convinced of wrongness of action he could not bring himself to make an open break with authority/senior that we should NOT loan money to this jobless guy.There were 3 things why they could not defy authority – bonus/salary , threat of losing job and act of obedience to superior . The experiment has proven that even when there was absolutely NO threat to job/life, there was not enough incentive in cash form, no pride in succeeding but just participation in a simple experiment still people went that far.

Hence it would be futile to expect that normal run of the mill people working in big banks doing credit checks and approving loans would use their System 1 or System 2 to think through and take a rational, independent , objective decision which goes against – Superior Orders , Incentives and a probable job loss/no promotion .This is exactly where System 3 comes into picture.

It’s a proven fact that seniors starting from CEOs were jumping up and down and commanding people to give as much loan as possible which forced lower officials to use System 3 of brains to give loans without proper documentation (aka robo signing scandal), risk assessment and complete disregard to any rational thinking(System 2) .

System 3 seems to be that part of decision making which takes into account the inherent trait of obedience of people to authority which compels them to do tasks/work which they would NEVER even dream of doing independently or would never do if they would use their Rational (aka System 2) brain.

—— everybody must see the documentary Inside Job http://www.sonyclassics.com/insidejob/_pdf/InsideJob_StudyGuide.pdf

Relating Superior Orders to actions of Rating Agencies

In short rating agencies screwed everything up. How did CCC rated bonds come together to magically become AAA which pension funds would . There were less than 10 companies which were AAA but thousands of crap bonds rated AAA which of course investors lapped up happily and faced consequences. The actual people who would go through the process of calculating the risk of default of CCC or other complicated CDOs etc are really very smart and intelligent (read great System 2 ) . Most would be finance majors or statistics major or Phds etc from top US and world universities.( . How could all of them together rate something as AAA which became CCC in next 3-5 years ?? Was all of their System 2 so bad that they could not conjure up a scenario where home prices may decline ?

Of course NOT. At least some of the very intelligent and smart people giving the ratings obviously knew something was wrong and maybe AAA was not the correct rating for loans which were pooled together . But they just could NOT withstand the Superior Order (read orders flowing directly from top officials CXOs etc for Moody’s , Fitch , S&P ). The ratings approvers could not use their System 2 to go against their immediate superiors implicit order to give great ratings to crap securities.

There was almost NO question of actually evaluating independently and objectively the bundled securities and rate them . System 2 was relegated to secondary place and System 3 took charge . Thy cannot displease the superior order not just because of fear of job loss or losing bonus but just OBEDIANCE. If Milgram has proven that ordinary people under superior order can inflict life threatening electric shocks to unknown people then if the CEO/MD of S&P, Fitch , Moodys has directed juniors to rate these crap loans as AAA then it shall happen . Its alice in wonderland to expect juniors to turn against the superiors and hope that they can counter this wrong doing. Infact just as Milgram experiment proves people felt happy they obeyed this is exactly what happened here as well.

System 3 was completely in work during 2004-07 in all rating agencies except Egan Jones.

Relating Superior Orders to actions of Insurance Company like AIG

“It is hard for us, without being flippant, to see a scenario within any kind of realm or reason that would see us losing one dollar in any of those transactions.” -Joseph Cassano, conference call with AIG investors, July 2007

Fact –AIG recived almost $182 billion to be rescued from hell. The above statement perfectly captures what Mr. Cassano would have been directing his lieutenants to do when the juniors had to take decisions to sell/write insurance(guarantee in case of default) and CDS contracts on the crappiest of the bonds and companies . AIG was happily ready to pay in case of default in return for premiums for various insurance and CDS contracts. Again the people who decide to insure against a default risk are the top Statistics, Actuarial , Finance Majors , Maths expersts from top notch universities around the world. They are NOT your normal dumb people. How could they blow up so spectacularly??

On Page 303 of Book Thinking Fast and Slow Mr. Daniel Kahneman writes :

“Possibility and certainty have similarly powerful effects in the domain of losses… Because of the possibility effect, we tend to overweight small risks and are willing to pay far more than expected value to eliminate them altogether….. Overweighting of small probabilities increases the attractiveness of both gambles and insurance policies…..Improbable outcomes are overweighted—this is the possibility effect”

Unfortunately in financial world particularly during boom times exactly opposite tends to happen because the Possibility effect ignores the fact that human beings behave completely differently while using System 3 . AIG actually completely underweighted Small risks(housing price decline) and was ready to sell insurance far cheaply than what it ought to have done . If you think I am wrong think about $182 billion bailout. The guys who bought CDS paid far less than what they ought to have paid to eliminate the small risks .But why???

One of the reasons is again people (insurance decision makers/underwrites) using System 3 in presence of strong Superior authority. When the then insurance ‘GOD’ Mr. Cassano tells the whole world —“It is hard for us, without being flippant, to see a scenario within any kind of realm or reason that would see us losing one dollar in any of those transactions.” Do you think that the lowly junior staff members who are actually deciding to sell insurance would dare to go against the authority??? Would you stand up Against Mr. Cassano ,,,,, THE MR. CASSANO ??

Imagine yourself to be the best Statistics, Acturial , maths expert with a spreadsheet to decide whether to insure this piece of crap bonds(rated magically AAA from CCC) . And your top lieutenant just made above command to whole world . What instruction you would have directly got from him or your immediate superiors??

Would it be Hey Mr XYZ here is a new bond you have to decide to insure . Use your System 2 or System 1 of brain , take a objective , rational decision independently and give a decision – Yes or NO for insurance ??

Or would it be – Here is something you have to do – Say yes and we will write insurance for this bond. Our Head has instructed it, declared openly to whole world. Just do it without giving too much of trouble to your brain.

What part of thinking would that junior staff would have used? Not System 1 or System 2 .

But he would do exactly what Milgram got it done for his experiment. Obedience to authority almost always trumps any rational decision making and this is exactly what happened with AIG as well. This would happen in every single company or any institution .System 3 forces people to take completely irrational decision which they would not have taken had they not been under an order from authority. Possibility effect completely gets sidelined. The actual decision to use rational brain to choose whom to insure and at what premium rate gets completely sidetracked in presence of an order from superior like Cassano.

From Milgram’s Experiment Conclusion

The situation is constructed so that there is no way the subject can stop shocking the learner without violating the experimenter’s definitions of his own competence. The subject fears that he will appear arrogant, untoward, and rude if he breaks off. Although these inhibiting emotions appear small in scope alongside the violence being done to the learner, they suffuse the mind and feelings of the subject, who is miserable at the prospect of having to repudiate the authority to his face. (When the experiment was altered so that the experimenter gave his instructions by telephone instead of in person, only a third as many people were fully obedient through 450 volts). It is a curious thing that a measure of compassion on the part of the subject — an unwillingness to “hurt” the experimenter’s feelings — is part of those binding forces inhibiting his disobedience. The withdrawal of such deference may be as painful to the subject as to the authority he defies

I would suggest you to read the above conclusion again and if needed again. What clearly comes out is that human beings are just not as defiant as probably they need to be . They become miserable when they have to go against the authority or superior orders.

Can the Juniors in Financial Institution Ever Stand Up to his Superior/CEO

The situation in experiment relates directly to situation in modern fin institutions. Nobody in any fin company can stand up to his superior/CEO without in a way questioning his own competence. Everybody working fear that they will appear arrogant, untoward and rude if he starts using his System 2 resources the it is supposed to be used for. They use System 3 so that they do not have to appear defiant , alone , rude ,stupid and lose bonus , jobs , promotion blah blah . The actual

With regards to experimenter giving instructions in person or via phone I think financial decision making would rarely change because a email , a quick phone call is all that is needed ONLY ONCE to force juniors to obery their seniors. The experiment needs constant encouragement and prodding by the experimenter and hence the physical presence is so necessary. But in real life financial institutions decision making process the juniors just need a small email or one simple conference call to clearly give exact kind of decision which they are supposed to make using the System 3.

Once the CEO and board decides to pursue a particular a way for the company the actual System 2 or the employees down the ladder gets almost suspended .

The questions which comes infront of the employees are NOT like multiply 17×34 or Subtract 448-39 while driving or a Linda Problem (http://en.wikipedia.org/wiki/Conjunction_fallacy) .These are questions which have exactly 1 answer which is correct and no opinions .

The questions which face real life people in financial decision making position never have exact one correct answer. But the CEOs and senior people prod , push , order the lower ranked ones to move towards one particular kind of decision which the juniors alywas obey no matter how stupid/conflicted/wrong those decisions be in eyes of juniors.

Juniors become absolutely miserable when they have to rate a crap CCC bond as AAA or sell CDS at prices which are laughable or give buy ratings to companies like Pets.com. Juniors own System 2 decision making part which should ideally be working fine because they are really smart people (all decision makers in financial industry are highly qualified with degrees from top notch univ) does not work when they are under a direction/superior order . They are forced to use System 3 .

Can the juniors actually stand up to MDs and CEOs and say NO ? Yes but in rarest of the rare circumstance they would go to defy authority in his face. The Unwillingness to hurt the superiors is just too strong a feeling for anybody , exactly the way Milgram has proven it to be.

Once you add other factors its well neigh impossible to use your rational decision making brain , knowledge , or System 2 to take a decision , Factors like :

- Your job, your promotion, your bonus, your salary depends on you obeying your seniors’ orders.

A person they suspends his System 1 and System 2 decision making process and uses System 3 to somehow prove that seniors orders are correct. Countless models are changed/constructed and backtracked after putting a final value (as decided by seniors) so that it seems plausible with explanation.

Valuing a company with no earnings?? NO problems just put something like a 50% growth in revenue and a 50% decline in costs for next 5-10 years to make sure that the final valuation for the company comes close to what you have been told to show. I have seen valuation models which assume a 45% CAGR Net Profits for 15 years for a company . Bingo you have released a research report with a price target so that your investment banking division can now peddle that to raise more money via IPO or secondary issue . You as an analyst is going to be appreciated in front of everybody. You just used your System 3 to avoid confrontation and show deference to authority disregarding your own System 2 and power to choose.

Rating a crap CCC bond??How to make it AAA?? Use your statistical knowledge, use lots of greek letters , make complicated models and assume that Home Prices never go down , no recession in future , etc . Bingo you have magically transformed a group of CCC bonds into AAA. And your superiors will give you high fives. (along with loads of money as well ) .

In the experiement when there was no one around, no threat to job , no negative incentive , no embarrassment infront of people , not much incentive still people administered life threatening shocks to unknown people . The poor people who work in financial industry at least didn’t do that but just obeyed what their master told in a high funda way whereby they could defend what they did using some complex methods/calculation with sometimes really ridiculous assumptions .

From Milgram’s experiment:

Duty without conflict

The subjects do not derive satisfaction from inflicting pain, but they often like the feeling they get from pleasing the experimenter. They are proud of doing a good job, obeying the experimenter under difficult circumstances. While the subjects administered only mild shocks on their own initiative, one experimental variation showed that, under orders, 30 percent of them were willing to deliver 450 volts even when they had to forcibly push the learner’s hand down on the electrode.

Now comes the most difficult part to reconcile with our normal notions of normal people. Do people enjoy inflicting pain ? Or were they basically sadist, psychopaths who just happen to work in normal jobs? The answer as pointed out by experiment is NO.

Subjects like the feeling they get from pleasing the experimenter. If there could be one sentence whole of HR classes in MBA have to teach this should be it. Even when there was no great incentive or threat or challenging work in the experiment still people like to please their superiors. Imagine what magical things superiors can get the juniors to do when order can be combined with incentives, threats , etc . All you need to do is to somehow invoke the feeling which most people inherently have relating to pleasing superior and obeying authority.

They are proud of doing a good job, obeying the experimenter under difficult circumstances. They are not worried about shocks to poor learner but they are more concerned about obeying the experimenter. They use System 3 which can completely disregard System 2 rational thinking part .

So does anyone think that bankers who have created such a havoc all around in last 3-5 years are going to take even an iota of blame for doing what they did?? Even Eichmann did not take blame but kept on saying he was doing what was ordered to him.

The bankers who did robo signing or approved crap shit loans (Countrywide is perfect example of those kind of people ) were actually proud of doing a good job at that time , obeying their superiors and giving ‘homes’ to homeless(of course pocketing huge bonuses as well). Without of course knowing or acknowledging the fact that they were not using their rational brain or System 2 but rather using System 3 which loves deference to authority.

Milgrams Experiment and Foreclosure Scandals

http://www.cjr.org/the_audit/nyt_criminal_charges_in_the_fo.php

http://georgewashington2.blogspot.com/2010/10/same-person-verified-billions-of.html

http://www.guardian.co.uk/business/2010/oct/14/wells-fargo-mortgage-foreclosure-robo-signer

http://money.cnn.com/2012/02/09/real_estate/mortgage_settlement/index.htm Banks ready to pay $26 billion to compensate for improper foreclosure practices. Now this is REAL . And believe me when banks finally decide to pay for something wrong they have done that something is REALLLLLLLLY BIG.

In short what happened is this – Banks made crap loans to all and Sundry . Bankers made bonuses had parties , enjoyed a lot . 2008 all hell broke lose . House prices declined and loans were more than value of houses. So bankers again did what they do best – CEOs directed juniors to go rampantly on foreclosing procedure. Laws be damned . Rules be ignored. Documents , signature , procedures can be fraud . Seniord didn’t care . They wanted foreclosures and juniors obliged by doing whatever illiegal they can.

There are countless cases going in court regarding the complete mess of robo signing where one individual would sign on 500+ foreclosure papers a day without any regard to logic , rules , morality , thought or anything remotely rational and legal .

Why did the junior most officers do this??

Again the people who have fraudulently and illegally evicted thousands of homeowners by peddling/signing fraud foreclosure papers are NOT inherently bad/sadistic or want to push pain on poor homeowners(most who have lost their jobs) . None of the bank officials are people who lack System 2 thought process . They are perfectly capable of taking a decision to evict a home owner from his house should be taken by duly following the procedures and having correct documents . But when the orders from superiors aka the CEOs (Big Swinging Dicks) comes they cannot disprove/disobey the authority precisely the way Milgrams subjects could not disobey. The foreclosure guys were ready to do completely illegal things like fraud and forgery to appease/obey their masters. As they say –“we were just following the orders” . I will say they were using System 3.

They know that they are going to cause immense pain to the homeowners and their families but its not that bad as disobeying the seniors is . When without incentives people in Milgram’s experiment were ready to almost kill others giving shocks these bankers were just , you know following orders and in a way taking home away from people who could not afford to pay mortgage anyway. This is how they would justify their actions to themselves. The people who did fraud for foreclosure did so as a sense of obligation to the superiors and company (which have given them salaries) orders, an impression of their duties as a banker/foreclosure officer, showing their competence for the job. Not from any peculiar sadistic/cheat/forger/fraud tendency.

People do not use System 2 while taking decisions where their superiors have almost already made them choose what they need to choose. Rational part of the brain stops working and System 3 takes over. Then people like bankers will easily do fraud signatures, sign 500+ foreclosures (like Linda Green) per day , etc. Its all normal after System 3 takes over.

Amazing Part of Milgram’s Experiment

The 40 psychiatrists who were asked how many people will administer full 450 volts – their answer was 1% . Reality was almost 60-80% of people readily administered the max killer voltage to the hapless victims. The experts on human behavior were absolutely wrong because they ignored the situational/conditions determinantsof the behavior in the process description of the experiment.

Hence any theory of any decision making under risk MUST consider the situations/conditions surrounding that decision making. Else that theory must be really limited in scope and outright wrong/useless in real life where most people make biggest decisions.

Million Dollar Incentives and its Effect on Decision Making under Risk

I could write a book on incentives but there are already too many theories and books available that I will spare repetitions and just go straight to disproving System 2 , rational thoughts , prospect theory , loss aversion , certainty effect , etc .

| Bank | Profits | Bonuses | $1 Million Bonuses | $10 million bonuses | TARP Govt Bailout Money billions |

| Bank of America | $4.00 | $3.30 | 172 | 4 | $45 |

| Citigroup | ($27.70) | $5.30 | 738 | 3 | $45 |

| Goldman | $2.30 | $4.80 | 953 | 6 | $10 |

| JPMorgan | $5.60 | $8.70 | 1,626 | 10 | $25 |

| Merrill Lynch | ($27.60) | $3.60 | 696 | 14 | $10 |

| Morgan Stanley | $1.70 | $4.50 | 428 | 10 | $10 |

•Countrywide Financial (now owned by Bank of America) founder and CEO Angelo Mozilo cashed in $122 million in stock options in 2007; His total take is estimated at more than $400 million dollars.

• Stanley O’Neal, who steered Merrill Lynch into financial collapse before it was taken over in a shotgun wedding with Bank of America in 2008, was given a package of $160 million when he retired.

• Bear Stearns former chairman Jimmy Cayne, rescued by a $29 billion Fed shotgun wedding to JPMorgan Chase, and received $60 million when he was replaced;

Anybody guessing how come the Superiors think about ordering those egregious policies read no further than above 3 instances . If you want to read more google ‘ compensation Wall Street CEO ‘ , You wont be disappointed.

Apart from the actual cash in TARP here is some more (

Average pay at the banks in 2010 was about the same as in 2007, before the bailouts.

Now I do not want to get into discussion with anyone whether pay is high or low but I guess it is reasonable incentive. When all hell broke loose Fed Reserve printed money like hell and lent almost for free $7.7 trillion to the bankers.

And their bonuses and salaries have not gone down as much as most would have expected.

So the age old question of decision making under risk stands tall – Does incentives have too much of affect on actual decision making??

Does actual act of decision making or fear of loss gets completely washed away when you have only upside but the downside can be easily spread across public??

Does privatization of profits and socialization of losses indeed change the way decision making under risk is done ??

Does normal theories of decision making still apply to these big banks which know for sure that they are going to be saved by Fed Reserve??(If someone says they were not saved please read the above BBG article again where Morgan Stanley took $107 Billion yes Billion with a B and Bank of America took $86 billion ..I can go on an on )

Again I will start with my most important point – How do human beings use their brain to choose between options when huge incentives are present which explicitly nudge them to choose one and reject other??

I am talking about all big REAL life decision making and not some $100 or $200 gain or loss on a coin flip during a leisurely walk in the park. I am talking about a million dollar in bonus or go home kind of situations.

Its amazing that Mr. Daniel’s book Thinking Fast and Slow has mentioned incentive word just 8 times. In decision making or thinking to solve a problem when different choices are present I think the most important factor has to be incentive, particularly for thousands of bankers who move money.

“You’re going to make an extra $2 million a year – or $10 million a year – for putting your financial institution at risk. Someone else pays the bill. You don’t pay the bill. Would you make that bet? Most people who worked on Wall Street said, ‘Sure, I’d make that bet.’” – Frank Partnoy, Inside Job.

See the great explanation of power of incentives by Charlie Munger (Vice Chairman of Berkshire and partner of Warren Buffett ) http://www.intelligentinvestor.com.au/articles/233/The-power-of-incentives.cfm

—Well I think I’ve been in the top 5% of my age cohort all my life in understanding the power of incentives, and all my life I’ve underestimated it(incentives).

http://www.rbcpa.com/Mungerspeech_june_95.pdf

The actual logical, rational thought of choosing an option is almost always secondary to the incentives (or threats) dangling infront of people and hence the theories which try to strip all conditions of real life decision making(like incentives) are incomplete. Again I am not talking about a coin toss and whether you want to choose to win or lose $100 or $200. I am talking about the decisions taken by the Lords of Finance when they have incentive dangling in front of their eyes and some choices to be made.

http://economix.blogs.nytimes.com/2009/09/18/whats-really-wrong-with-wall-street-pay/

In short it says this – If you are a mortgage trader you had a chance to get huge bonus (and your superior as well) if the bet paid off . If you lost the bet and firm lost money you will not receive bonus at all . Maybe you can land a princely severance package and land up at another firm .

But in no case there would be a “negative bonus” . In other words you will personally not incur the cost of trading blow up in any circumstance. Its guaranteed.

“Economists call this a moral hazard problem” I can only smile.

On Page 323 –

in 2007 no banker had personally experienced a devastating financial crisis.

I don’t know a single banker CEO who had an age less than 45 years in 2007. If someone knows please let me know because as far as I know you cannot have a Bill Gates or a Zuckerburg in Banking. My questions –

Do Bankers need to personally experience a financial crisis to know that they should NOT do X?

Did a banker need to experience a fin crisis before deciding to give loan to a No income No job person?

Do you really need to face a head on collision to know that its more dangerous than a side on collision or going into a ditch?

Now that all bankers have experienced a fin crisis all is going to be well before all these experienced bankers die/retire and completely fresh NEW bankers come in?? (Mathematically it should take around 40 years, and I would love to bet against anyone under the sun that next fin/banking crisis will take that long)

How is it that after almost every 8-15 years there is a banking/financial crisis?

Recent Historical Evidence and behaving the way others have behaved in that position:

All bubbles and manias and NON RATIONAL Decision making by financial institutions happens because a lot of people have made a ton of money which seems unjustified to the amount of value they are creating for society in a pretty short time–greed. When your senior in the company and your competitor have been choosing X over Y for last 2-6 years and been handsomely rewarded with money , power , beautiful girlfriend/wives , Ferraris , Lambos, Bollingers , then the question of choosing Y almost does not arise or at least is not given the thought/importance as it should be. The decision makers will automatically choose what has been working in the recent 2-6 years and which has been rewarding the other guys. The actual decision of choosing X over Y is almost not thought about but the financial models are appropriately changed —so that they make choosing X look good.

Recent Historical Evidence effect on Decision Making

1968-72 – Tech industries and 70+ p/e when Warren Buffett closed his partnership saying he cannot invest in this kind of market. Hard to find sell recommendations on IBM , Polaroid , Kodak, Xerox, et all and all almost close to 3 digit p/e . Of course the next decade S&P 500 lost almost 50% in real terms with the biggest losses from the tech industry.

Latin American loan mania and Savings and Loans crisis –All bankers rushed in for these crisis and bailouts followed. Lot of US banks (Citi being prominent) made lot of high yielding loans to Latin American countries and they initially made tons of money. This recent success and money kept making the bankers to keep giving loans to these countries even when they knew that they are taking higher risk. Surely the probability of not being paid was NOT 0 . But this risk was relegated to secondary position. What mattered and was of primary importance was whether lots of your colleagues/seniors and competitors have made lot of money by doing something. That is exactly what happened in Savings and Loans Crisis as well . The so called objective and independent minded decision to lend based on purely risk reward goes to Secondary importance.

Leveraged Buyouts craze during 80’s. Even a 10th Grader could have told that if current profit is not even enough to pay for interest how can company survive? It is going to make thousands lose the job and it did happen. Try describing all these with any amount of probability to the investment bankers and guys making the deals and getting their millions. Every effort to warn people would have failed to stop these kinds of madness.

1999-00 Nasdaq had a p/e greater than 200. http://www.ameinfo.com/16513.html . Sane individuals should have noted that there is at least a 5-10% chance that it may fall(Read annual reports of Buffett , Oaktree Capital , Sequioa Funds in 1998-00 which explicitly say that this is a bubble and they completely stayed away). But please go and have a look at all the research recommendations from top banks and equity analysts what they were predicting. Thousands of programmers lost the jobs because money driving the companies evaporated as the crash was severe. Millions of people actually put their retirement savings in the hot IT stocks on recommendations of Analysts , Banks and of course CNBC.

Of course there was more than 5-10% chance of big decline in Nasdaq and other big high flying IT stocks but no matter how badly anyone would have described the impending crisis the guys whose bonuses(read equity analysts and bankers who make deals n IPOs) would NEVER EVER have warned or chosen to keep money in a saner company having a p/e close to earth than heaven. After all what had worked fabulously in 1997-98-99 was sure to work later as well . In any case IBG — YBG (I’ll be gone, you’ll be gone).

Subprime Mess – Lesser said the better it is.

What I am trying to tell is that with the recent historical memory/evidence decision making under risk changes completely from anything what any economic theory of rational decision making may imply . Choice/Decision per se becomes secondary while the recent historical evidence is given priority. Recent Historical Evidence/rewards cannot be neglected while making any theory of decision making.

Institutional Imperative – Warren Buffett

Warren Buffett has put in beautifully in his 1989 letters to shareholders(http://www.berkshirehathaway.com/letters/1989.html) terming it as institutional imperative . In short it means that behavior of peer companies will be mindlessly imitated by others no matter how wrong they may be. This means rationality in decision making takes a backseat if the recent evidence suggest that competitors have made money by choosing X(however dangerous or stupid that maybe) .Others will do exactly the same . “Everyone is doing it “ is the favorite explanation given. Looking collectively Stupid is fine but looking alone and making a mistake is equivalent to death .

Here are some sample questions I have prepared which unfortunately should have been asked at those points in history to gauge the answers and reactions:

Year 1980-82 (Background – Between 1979 and 1982 the Debt to Latin American Countries has doubled. With this the 8 largest Banks in US have made tons of loans to Lat Am countries. There has not been a default till date. The bankers, risk managers, deal makers have all had great time, lots of money, lots of promotions and enjoyment for the last 7-10 years. CEO of Citi Wriston has said – “Countries don’t go bust “)

You are a risk manager or loan approver of a Large US bank. Which option will you choose?

X. Approve/Give a $1 billion loan to Mexico/Brazil/Argentina etc.

Y. Not to approve the loan based on risk reward calculations.

You May be best MBA, Phd, guy but if CEO says Countries don’t go Bust You Agree

Citi CEO Wriston in early 80’s said – “Countries don’t go bust “ and in next 1-2 year 20 countries went bust and could not pay back the loans . Citi itself was rescued. Now if CEO says that kind of sentence what will their juniors who actually sit and decide do –whether to give a loan to Mexico or not whatever be the probability of Mexico paying you back . Of course the decision of actually giving/approving the loan to Mexico or any other crap country is secondary. The juniors will use System 3 taking into account following three items:

- Superior Orders- The CEO (as shown above for CITI) has directed you and firm to approve the loans to Latin American Countries.

- Incentive – You will receive your bonus if you follow what your superiors are saying you to do .

- Recent Historical Evidence – For last 4-6 years loans have been performing.

Now the actual term sheet of loan evaluation should be shoved on the table of the loan/risk manager.

Do you need a Phd in economics to decide to approve or disprove the loan??

Will you actually use your System 2 to laboriously, objectively, rationally evaluate the loan proposal and reach a conclusion which may be different than what your superior is saying??

Of course NO.

You may be the best Maths , Statistics, Economics, MBA , Phd guy in the world and have a title of Most rational person in the world but when faced with the complete picture of decision making of approving a Billion Dollar loan you will NOT use your independent thought process. You will instead fall for using System 3 because the circumstances for decision making are more important than the actual choosing of decision.

I have given just one example but anyone can easily see that you can make 100s of examples of situations where people would have rejected a conclusion had they not been under an organization , no superior order , not a incentive to choose a decision or neglect the recent historical evidence however stupid it might have been .

Behaving the way others have behaved in the position—Zimbardo Experiment

This may not be intuitively clear when you have read the heading but it will become once you read the amazing Stanford Prison Experiment by Zimbardo . http://www.prisonexp.org/ , http://www.prisonexp.org/pdf/evil.pdf http://en.wikipedia.org/wiki/Stanford_prison_experiment

In short conclusion is this – 24 males who were deemed to be the most psychologically stable and healthy(no history of crime, drugs or any illegal activity) were chosen wherein half of them became prisoner and others become guards in a prison like environment.

The guards were given no specific training on how to be guards. Instead they were free, within limits, to do whatever they thought was necessary to maintain law and order in the prison.

Experiment created a situation in which prisoners were withdrawing and behaving in pathological ways, and in which some of the guards were behaving sadistically. Even the “good” guards felt helpless to intervene, and none of the guards quit while the study was in progress. Indeed, it should be noted that no guard ever came late for his shift, called in sick, left early, or demanded extra pay for overtime work.

Second, Christina Maslach, a recent Stanford Ph.D. brought in to conduct interviews with the guards and prisoners, strongly objected when she saw our prisoners being marched on a toilet run, bags over their heads, legs chained together, hands on each other’s shoulders. Filled with outrage, she said, “It’s terrible what you are doing to these boys!” Out of 50 or more outsiders who had seen our prison, she was the only one who ever questioned its morality.

all the prisoners were happy the experiment was over, but most of the guards were upset that the study was terminated prematurely.

After observing our simulated prison for only six days, we could understand how prisons dehumanize people, turning them into objects and instilling in them feelings of hopelessness. And as for guards, we realized how ordinary people could be readily transformed from the good Dr. Jekyll to the evil Mr. Hyde .

Lets try to understand how can we relate this experiment’s conclusion (role playing ) to modern finance where it really does seem every bank is just out there to use any means(however illegal) under the sun to take money away from you and society .(If you disagree maybe you are working in a bank . Just ask how much trust your friends have in banks and if most say yes huge trust probably you need to change your friends).

Powerful Men in Finance and their Positions

The CEOs of the top 20 banks and to 20 investment banks are the pinnacle of what a person would want to achieve in financial industry. I do not have data but most probably these bankers move almost 80% of the money in the world. They hire the best and brightest from top universities and Ivy League colleges as they say creame de lemme of the world.

Even after knowing hundreds of fraud cases and paying billions in fines How many of the people from top banks do you know have been convicted of doing anything illegal personally and have had to pay personal fines? Or their bonuses were clawed back for excessive risk taking, defrauding, cheating, lying ?

Do you know any instance where a junior person refused to do a job in big bank because it was too risky or illogical or did not make sense, not in interest of clients?? Do you know any guy in all those banks combined who resigned because banks were approving loans to No Income or No jobs people ??

All answers would be NO.

Do you think that almost every guy at the banks are unethical? or they Could not evaluate logically the negative affects which would result because of their actions ?

So what happens exactly when a guy from a top notch IVY league college who has been in top percentile throughout his life in all endeavors enters into a Investment Bank or a big Bank?

What happens when a person sits at the trading desk whereby his seniors had once sat and did all kinds of things and are enjoying today? How does he feel? How will he act? How independent will he be from the position he occupies?

I believe that once a person enters into a big financial institution and occupies a position where no one has ever been convicted/punished/bonus taken back/lsued personally- he starts to think in a completely different way about the job/work he does.

Ordinary People Start to Believe in Magic of Finance and Act as others have acted earlier in their position

He starts to behave the way the guards in Zimbardo’s experiments behaved. Ordinary (infact brilliant guys) people who enter into banks start behaving in a way which is true to the position which they occupy i.e. do whatever is possible (even illegal) to make money at whatever cost. Previous guys have done it . Some of them come in Rolls Royce , some of them own ranches , yachts , super luxury mansions . Why should not you do it ?

What stops you from doing “it” ? Nothing. Your superiors encourage you to do it . Your peers in other company are doing it . With all these things going on will you actually start using your System 2 and evaluate whether or not Pets.com is a great company of future or CDS sold by AIG should be priced high?? Or will you reject the loan proposal of the jobless widower who is a father of 4 kids ? IBG n YBG . I will be gone and You will be gone is the mantra in whole of the company.

You call your clients as “muppets” . Goldman had to pay $500 million + to settle a suit where they defrauded clients . Do you know anyone who was personally punished/fined/lost job in Goldman for doing that deal ?? If no then how can the fin industry be different from a typical prison where guards can literally do whatever they want to do to the prisoners and not be punished EVER.

Isnt there a huge similarity to the position held by a financial industy guy and a prison guard ?

When in 6 days perfectly normal people who never did crime , never were in prison , never got any training in how to behave as a prison guard start behaving in a sadistic way in a controlled experiement with paltry ($85 a day pay) how can we expect the financial industry guys to behave in a independent/logical/rational/objective manner when they are sitting at a position where nobody has ever been punished/caught/held liable personally . Use System 2 or loss aversion or denominator neglect or certainty affect or prospect theory or bernoulli’s utilities ??? You’re kidding right.

I am sitting in a Goldman Sachs office being the trader of mortgage securities. Do I F#*&kng care or think about what will happen to the subprime bonds I have sold when house prices will start falling ?? Not a single Goldmanite has been punished/imprisoned/held liable personally ever even when Goldman has had to pay fines in millions of dollars.

Mr. Corzine the CEO of MF Global has been roaming absolutely free for last 8 months after his firm stole money from customer’s segregated accounts . Almost $2 billion has vaporized and not a single indictment has yet been put on the CEO Corzine (who incidentally earlier was Goldman CEO). My bet is this on Mr. Corzine . He will NEVER EVER be convicted for cheating the customers. EVER . He will instead be employed by some other firm and will enjoy making millions of dollars again.

Do you think I being in Goldman will act rationally/ethically/morally/?

Or will I act the way previous guys on that position have previously acted and reaped riches of rewards possible in this world with zero downside??

LIBOR itself has been manipulated by all the big banks for so many years. Don’t you think that there should have been one guy , one person who would have stood up and said NO ??

You do not need a psychology degree to decipher that people start to act according to the position and situation they are put in even though they are not inherently evil . As someone said “Evil is knowing better but doing worse” Guys know its wrong but they will even then do because they are acting with their System 3 .

Not for a second I am telling that most people in banks are immoral or evil but lot of them do act immorally because they are in that position which has had a history of people doing exactly the same wrong thing which they are supposed to do. Cheat/defraud/do anything to make your bonus and keep your high paying job. It’s the position stupid!!!!!!!! Not the people.

Because of the enormous power which is present in financial institutions the absolutely normal people who enter their become exactly what the position is known for . Ruthless, heartless, ready to defraud, cheat, lobby, change rules in your favor by any means, etc becomes ingrained in anybody who sits in that position/situation.

A sample questionnaire should be phrased like this :

Imagine you are a subprime bond sales man in Goldman Sachs . A guy comes to you and says he wants to buy it . He is Mr. Z . Another guy comes and says he wants to bet against the subprime bonds . His name is Y. What will you do if you do ?

Here is what Goldman did – Make both clients happy . It chose the worst subprime bonds and sold to Mr. Z. Then turned around gave the exact list to Mr. Y so that he can bet against and make tons of money all the while telling Mr. Z that these bonds are really good and there will not be losses as far as their models say . Abacus deal .

We can debate endlessly about what is right or what is wrong in this but end of day Goldman paid $550 million fine for doing this . Do you think Goldman guys are that stupid to NOT have know prior to dealing like this that they might be caught ?? Of course yes. But the position at which they sit so many times they have gone completely scot free that they just did it .

The head guy Tourre who caused Goldman to pay $550 million in fine is still working at Goldman and must be receiving bonuses as normal . http://www.linkedin.com/pub/fabrice-tourre/21/126/9

So what would you do if you sat in Mr. Tourre position tomorrow ?? Would you back out and use your System 2 , loss aversion , denominator neglect or god knows what to decide on financial risk taking or would you do what your System 3 says – Go for it . The guy before you on this position and who caused $550 million fine is still with the firm and enjoying his grand life.

Other People’s Money at Risk – OPM

I have yet to see a economic/pshycological questionnaire where it starts with – “You are managing other person’s money or Will you bet somebody else’s money if odds are XYX —————– “

I searched Google but could not come across any decision theory which could be applied when people are managing other people’s money.

Will the prospect theory or loss aversion or certainty effect apply to the same extent when somebody else’s hard earned money is at risk?

My answer is NO.

OPM- Other People’s Money here will refer to investors who put money into various hedge funds and of course the general public which puts money into the banks . The bankers and fund managers are people who manage other people’s money.

So how do these money managers and bankers take decision under risk ? Do they take decisions just as we take with our own hard earned cash ? Do they have similar loss aversion as we people have with respect to our own money? A simple guess by anyone would say NO. There is a huge differenece in the way decision making is done when your own cash in on the line vs when someone else’s cash is on the line.

Of course officially money managers have great incentive to make sure they don’t lose money for the clients , make money for them else the money manageres and bankers will lose the client or get less business from them.

Unfortunately this does not represent the complete picture of the situation/condition for bankers and money managers.

Most hedge fund managers charge 2% of assets and around 20% of profits . There are almost 8000 hedge funds – Howard Marks on Bloomberg TV 17/72012 . When Marks started his career in early 70’s rarest of rare managers were able to charge this kind of exceptional incentive arrangement. Do you think there are 8000 exceptional guys right now ??

Infact on an average hedge funds with all their strategies and incentives are trailing even the S&P . http://www.businessweek.com/news/2012-07-11/hedge-funds-trail-vanguard-as-elliott-returns-atypical

So much so for 2 plus 20.

For bankers well enough said . We people don’t have a choice . The banks before 2007-08 crisis have become even larger than ever . Where will you put your money if not a bank ?

How Questions on Decision Making under Risk Should be Asked

So lets get to actual framing of questions for Fund Managers which are used by decision theorists when someone else’s money is at risk .

- Your money is safe in bank. You are going to risk someone else’s money

- You have already received 2-3% off the money poured in your fund .

- You will get 20% of the profits.

- You will NOT have to share even a penny of loss.

- Suppose whole invested money goes to 0 you are NOT liable personally.

- If you blow up most probably everybody is also going to blow up (as has been case in history) . If you blow up individually like LTCM did don’t worry you can still have your career later as proven by the guys who ran LTCM (they are still managing money).

Now all questionnaire asked by Mr. Daniel Kahneman for developing all his theories on decision making under risk should be put in .

Pre-Conditions for Bankers(who were earlier makings tones of money using prop trading and now still managing money for depositors in trillions of dollars)

- Your money is safe in bank . You are going to risk someone else’s money

- You will keep on receiving continuous monthly salary no matter what you do.

- You will receive great bonus if you take a huge risk and it pays off.

- You will NEVER receive a negative bonus or clawback no matter how badly you screw up .

- No matter how much you lose for the client/customer you will never be held personally liable.

- All profits if any will be credited for your great strategies

- All losses will be because of completely unforeseen events(you know those 3-5 sigma events which keep happening once every decade or so) and most probably all your competitors will also be losing same amount at same time (why do banking crisis seems to affect every single bank )

- Even if you have to bend the rules a bit no problem. The bank will pay the fine for you and you will continue your job or you will land up with even bigger pay packet in other company. (Question for readers – pick out any big fine paid by any banks over years and let me know one guy who was fired or held responsible for it .)

Let me explain how Loss Aversion theory becomes less important for money managers and bankers most of the time.

Another central result is that changes that make things worse (losses) loom larger than improvements or gains. The choice data imply an abrupt change of the slope of the value function at the origin. The existing evidence suggests that the ratio of the slopes of the value function in two domains, for small or moderate gains and losses of money, is about 2 : 1 (Tversky and Kahneman, 1991