Dish TV India – A Critical Analysis

Why would a Senior Management Personnel Not answer what is Debt/Equity ratio of company

I was randomly just watching business news channel (whenever I want some fun I put on Biz channels in morning at around 9 AM when guys give ways to make money in next 3-4 hours!!!) and came across startling fact whereby a Dish TV senior management personnel on TV did not answer – what the debt to equity ratio of the company is and gave an evasive reply . (Early week of December)

Couple of days later I heard same thing from someone senior from a company WWIL refuse to answer the Debt to equity ratio question . It was amazing and that led me to dig a bit deep into what are these companies where the management just DOES NOT answer the most basic question – What is the Debt Equity Ratio of your Company ?

Ben Graham’s Advice

I will start off this analysis by quoting the real Guru (Benjamin Graham) who laid down rules of investment around 80 years ago which are:

“You may take it as an axiom that you cannot profit on Wall Street (or Dalal Street) by continuously doing the obvious or the popular thing.”

“What seems to be obvious and simple to the people in Wall Street, as well as to their customers, is not really

Obvious and simple at all . You are not going to get good results in security analysis by doing the simple, obvious thing of picking out the companies that apparently have good prospects — whether it be the automobile industry, or the building industry, or any such combination of companies which almost everybody can tell you are going to enjoy good business for a number of years to come. That method is just too simple and too obvious — and the main fact about it is that it does not work well.”

Simplest and Sure Way to Make Money in Stock Market in Growing/Nascent Industry– DTH

Lets go back to history and imagine its May 2007. I start to get Goosebumps just thinking about those “times” but just for a second imagine that it indeed is May ‘07. And you obviously think that stock market investing is actually simple. Pick a industry which is very small as of today and you think (and everybody on TV thinks) it is going to grow tremendously in the coming future. Then pick the company which is the largest/best (as per you or TV people) as of today and put your money in it and then sit back and relax. You are surely going to make money.

Having these thoughts in you’re mind you then come across this:

“The DTH Industry revenue is expected to grow @ 80% compounded per annum over the next 5 years and will be in the range of Rs.100 billion in 2011”. Dish TV Annual Report 2006-07.

(Curious I am, as no one , not even consultants ever say that this industry will have PROFTIS grow at X% compounded per annum- their favorites in 2006-07 were INSURANCE ,Organized retail , infrastruture and power, capital goods, real estate, value added services in Mobile Telecom-All industries where capital has been destroyed like hell(if you do not believe me check out their share prices or pockets of the private promoters !!!) . Consultants always say it’s the revenues that will compound and thank god for that.)

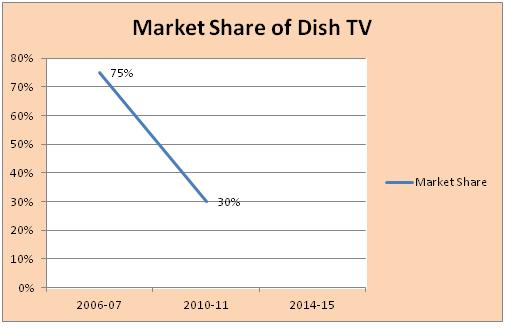

(Just checked by March 2011 Dish TV revenue with around 30 % market share(volumes) having revenue of around Rs. 15 Billion would translate to at max Rs. 50-55 Billion in revenues for DTH Industry even till Dec 2011 . Again someone missed projections by JUST 50% and the guy would still have his job – believe me.)

That is the Eureka Moment you were waiting. In fact you might even have just got Dish TV in your home and you just absolutely enjoy the picture quality and other services it provides. So you would do what a normal or should I say what 99.9% people would do : Go buy the stock of Dish TV so that you can participate in the phenomenal growth of a nascent industry and reap rich rewards .

I mean some industry is going to grow @80% CAGR(OK if you are old/conservative/boring/married you can do it half @40% still its phenomenal growth) so there is no way you could lose money . I mean can there be anything simpler than putting money in DTH company which is by far the largest and has market share 75% in that industry(as of 2007) ?

You thought you have just found out the next Microsoft or a Apple iPod/iPad kind of market because I seriously do NOT know any market where one company has 75% market share.

So with this great insight you just had you went ahead and Bought Dish TV Shares @Rs. 140 (May 2007)and you felt very happy at the time of making this investment. (Of course you have never read anything about Margin of Safety or Ben Graham)

How Can you have losses in Dish after holding for 4 years ?

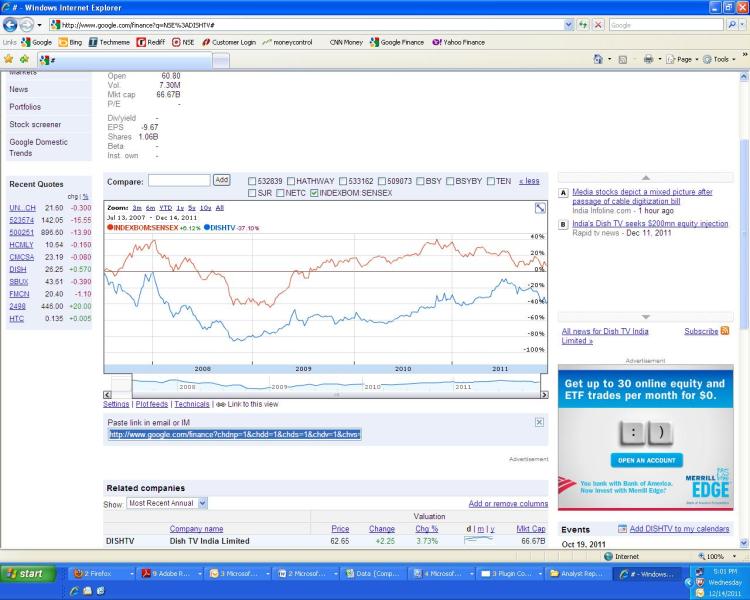

Circa 2011 December – Price of Dish TV Stock is hovering around Rs. 60 . (Congrats for holding for 4 years)

Your capital which you had put has halved in 4 years after you made the investment.

How is that possible? How come an almost sure way to profit from phenomenal growth of a completely new industry and betting on the largest player (mkt share upwards of 70% at time of investing) actually make you lose 50% of your capital in 4 years of holding the stock?

(Thank God you did NOT buy WWIL-Siti Cable which is largest MSO (read- cable kind of operator) which had price of around Rs. 139 in May 2007 and has a price of around Rs. 7 today-NO TYPO . 95% of market value erased from the stock. So much so for great growth in an ever increasing industry .Curiously that is also related to Zee and Mr. Subash Chandra .Oh and ICL (not IPL) was also related to Mr. Chandra).

For analyzing this and to try and predict the future of market value of Dish TV(sorry I Cannot do that) I would suggest you to read what I have put at the start of this writing. Read again what Ben Graham (the guru of Buffett) told investors when almost all of you who are reading this were NOT born. ((if anyone indeed would read this J ))

As of today(December 2011) I could NOT find a single sell rating on Dish TV by any analyst. (http://www.milkorwater.com/india/stock/Dish-TV-India-/DISHTV/lstId=196332)

I am sure there was NO SELL RATING EVEN IN May 2007.(Reminds of time when finding a single sell rating on Unitech was equivalent to finding Black Money of India stashed abroad – sometime around 2007 !!!!! It has lost “just” around 90%+ from there. http://www.google.com/finance?chdnp=1&chdd=1&chds=1&chdv=1&chvs=maximized&chdeh=0&chfdeh=0&chdet=1323862011073&chddm=482885&chls=IntervalBasedLine&q=NSE:UNITECH&ntsp=0) )

DTH and Dish TV Subscriber Growth in India (Some positives initially!!)

Let’s have a look at the phenomenal growth in DTH industry in India.

From almost negligible subscribers in 2004-05 to almost 40 million by September 2011 it’s been perhaps only 2nd to Telecom Industry Growth in India. Whichever way you look it is just mindboggling.

Dish TV Customers and Revenue Growth

Apart from this the website of Dish TV for investor info is the BEST Indian Website I have EVER COME across in terms of info available there – right from Investor presentations to transcripts of con-calls. This blog entry would not have been possible with this amazingly informative website. Other companies must learn from Dish TV.

By the way is there any logical/financial/technical reason for companies not giving financial data in Excel on their website?? I would like to talk to companies’ CEOs in a way Steve Jobs would talk if some engineer told to him in 2004- “Hey Jobs this is a prototype of iPhone smart phone with touch screen and a stylus where you just need to click 5 times to go to email through 3 nested menu and 2 drop downs . Simple !!!! The phone does email and its smart phone !! “ Now imagine how would Steve Jobs reply and that’s how I would reply to any CEO who tries to answer WHY THE HECK THERE IS NO EXCEL based financial data ON WEBSITE with Financial Details in it . If someone knows any company which puts data like that do inform me .

Source: Dish TV Investor presentation Oct 2011.

Unfortunately I can put together only the above 3 charts which seem positive for Dish TV. The rest as the saying goes is FUTURE (not history) and based on “Hopium”(Term borrowed from http://www.zerohedge.com/ which is the BEST website on finance ever by a wide margin)

Pathetic Condition of Company Finances

Consistent losses since existence

I know that if a new business has been started then a lot of capital expenditure is indeed warranted and company may not make profits for some years. But it should make profits some day else there is no point in having a company when all rewards are going to the creditors/bankers.

Source: Moneycontrol for Profit and Loss Statement of Dish TV.

(For the eternal optimists who think/hope that in 2011-12 Dish TV will make profits please read my comments on creative accounting in this document dealing with impairment of assets worth Rs. 174 crore.)

Consistently increasing Debt

Source: Moneycontrol for Total Debt of Dish TV

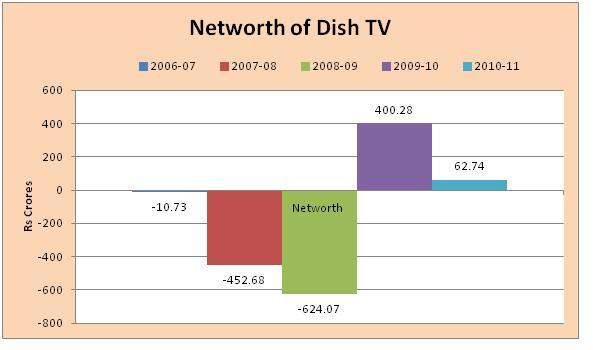

Net Worth of Dish TV (is there anything “worth”)

Source: Moneycontrol for Networth of Dish TV.

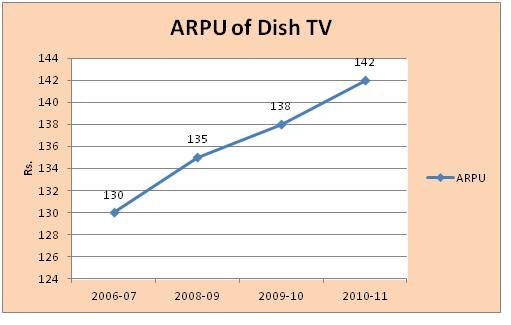

ARPU trend Dish TV

(is this the phenomenal Growth people were expecting out of “amazing” pricing power and brilliant growth business??-Meagre 10-12% increase in 5 years of existence-My Vegetable wala and Milkman had a higher % increase in prices)?? Any magic expected in future??Don’t even ask me what has been inflation rates over last 3 years)

If some business cannot hike price higher than inflation rate and that is the only source of substantial income for the company how is it possible for the company to make enough returns on capital??(Currently most expensive package rates are Rs. 350 for normal package a increase of only 17% over 4 years . Is that what is called pricing power?)

Consistently Falling Market Share of Dish TV (Did Someone say first mover/competitive advantage ? hmm?) .

5 year Stock Return of Dish TV Vs Sensex (Did Someone Say Amazing Growth Opportunity in 2006-07?? Or is someone saying LONNNNNNNNNG term??)

The Seemingly Never Ending Thirst for Cash by Dish TV

Dish TV has been guzzling cash since existence at a rate which seems higher than Hummer might do with the Diesel in its tank. I absolutely agree that Dish TV being in early stages of a business will indeed require cash in a competitive field where others are undercutting it but when will cash raising(by debt or equity) actually stop or maybe become really small ?? 5 years more?? or 10 years ??

Just for example :

Total Debt on books as of September 2011 = Rs. 1200 crores.

Earlier GDR + Rights Issue = Rs . 465 + 1140 = 1605 crores (apart from equity initially raised) .

On top of these it is waiting to raise another $200 million.( http://www.business-standard.com/india/news/dish-tv-tapping-investors-for-rs-1000-cr-fund/457996/ )

Why the hurry to raise cash?? Net Worth Completely Eroded Due to Losses (Rs. Lakhs)

| March 31 2011 | Sept 30 2011 | |

| Share Capital |

10630 |

10634 |

| Reserves and Surplus |

153140 |

153300 |

| Accumulated Losses |

157496 |

164183 |

| Net Worth |

6274 |

-249 |

With a negative networth I am not sure why business newspapers are saying Dish TV will raise money to fund expansion or technology up gradation or blah blah which typical business newspaper reporters say . They should report –“With a networth of company completely eroded the company MUST raise equity to support Rs. 1200 crore odd debt which is almost 70% dollar denominated (read more pain) “

Last time it raised money via rights issue more than 55% was used to just pay back the loans. It will happen again. The only issue is how come investors again will give upto Rs. 1000 crores so that company can retire debt of around 11% per annum. What risk premium or return are investors demanding for this easy money??

Actually companies are forced to go to BIFR (read : you are bankrupt save yourself whatever is left) if their networth gets eroded to huge extent .

http://www.moneycontrol.com/news/business/hindustan-motors-what-led-to-networth-erosion_455837.html Hindustan Motors is going to report to Board of Industrial and Financial Reconstruction (BIFR) as its networth has eroded by 50% from the peak in the preceding four years.

Hindustan Motors’s FY09 equity stood at Rs 161 crore, reserves were at Rs 12 crore. For FY10, the company’s accumulated loss till 31st March 2009 stood at Rs 131 crore. FY10 consolidated net loss stood at Rs 50.5 crore

Huge Problem coming up as Loans are Expensive, Equity markets in Turmoil and No GDR/ADR to save the Day

With total Cash balance of just Rs. 250 odd crores in last quarter(Sept 2011) there seems to be problem coming up rapidly for Dish TV .

Debt : With RBI having raised rates countless times and only paused the rate hikes now its going to be tough going for Dish TV as it can only raise money at very high rates .

Domestic Equity: Of course in 1 year equity markets have corrected by almost 20% in rupee terms and almost 30+% in dollar terms so things are not really rosy there.

ADR/GDR : Having raised money via GDR earlier(when Mr. Bernanke was dropping money from his helicopter- if you do not understand this try to know meaning of QE not from Bankers’/Bloomberg kind of websites but from guys like Bill Gross, Jim Rogers, Marc Faber, Ron Paul or Zerohedge website. You might be surprised) this time it seems there might be some problem.

Times of India 21st dec .“There were hardly any major GDR issuances during 2011 and the largest GDR of the year 2011 was just $32 million from Rasoya Proteins. The average size of GDR in 2011 was $18.3 million compared to $26.6 million in the previous year.”

“There was not even a single ADR issue in 2011. However, companies raised about $220 million through GDRs ( Global Depository Receipts) during the year”

Avalanche of payments coming due in 2011-2012 and Sure need for Cash(Debt/Equity)

From Annual Report 2011-

Term Loans Due within 1 year – 485,756,250 + 500,000,000 + 2,100,000,000 = 3085756250

Buyer’s Credit Due within 1 year – 757,849,183 + 594,961,250 = 1352810433

Total Payments Due within 1 year = 3085756250+ 1352810433 = Rs. 4438,566,683 (Rs. 443 crores)

Total Loans Due within 1 year = 434 crores (as of March 2011)

Total Profits till 6 months of FY 2011 – Loss of 66 Crores.

Total Cash and Bank balance as of September 2011 = Rs. 251 Crores.

Pardon me if my math is bad but if you have Rs.251 in your pocket and you have lost 66 and you have to pay back 434 in next 6 months with almost no possibility of profits coming in next 6 months how do you do it??

Apart from once again taking loan to pay back the other loan or raise equity or may be doings some “scheme of Amalgamation “ .

I am not sure how much the bankers are going to be willing lend again but seeing the way they are doing with Kingfisher I think Dish TV is in much better place .

Why will Equity Investors help raise Money – my best of luck to investors who will be diluted and rest ones will give their money to Dish TV so that it can just pay back the loans taken.

Last time it raised money via rights issue more than 50% was used to just pay back the loans.

Mark my words – no matter how much they raise in 2011-12 they will quickly will run out and they will be back again in markets sometime in 2013-14 for more cash.

Converted Rupee Debt to Dollar Debt in 2011 (Smart hmm ..!!! )

Sure losses coming in Next quarter

Concall October 2011 – Rajeev Dalmia We have replaced some high cost rupee debt with dollar debt and because of that adjustment an additional loan of 150 crores We have taken forex loans from various banks which is around Rs 700 crores. There was a loss on account of forex fluctuation between the last quarter and this quarter amounting to Rs 30 crores.

From April to June Qtr and July to September the INR-USD changed from around Rs. 44.5 to Rs. 49 which is a 10% move .

Current day (Dec 18) rate is almost Rs. 53 which is another 10% move from October start. A crude calculation will say that company will take a hit of another Rs. 30 crores at least assuming INR-USD does not move too much from 52.5-53.5. God knows what will happen if it goes to 58 or 59.

Although management said Rs. 65 crores of Foreign debt coming due in 1 year are hedged I have my doubts about any company saying it’s hedged against INR-USD volatility.

Of course the with India’s accounting bodies hell bent on mollycoddling corporates will make sure companies do NOT report the losses on P&L due to Dollar Loans losses .

“The country’s top accounting standards body is once again set to come to the rescue of India Inc to help it sail through the current difficult times in the light of significant rupee downslide against the US dollar in recent months.” http://www.thehindubusinessline.com/companies/article2742137.ece?homepage=true )

Rupee Depreciation and Cost increases

Whatever has been Subscriber Acquisition cost (SAC) it would have gone up by at least 17%-20% because rupee has moved from around 44 to 53 vs USD within last 6 months.

In simple terms DISH TV’s costs this quarter would have increased by 15% at least while of course it cannot raise prices to that extent. End result – if it was NOT profitable last quarter I do not know how it can become profitable in coming 2 quarters (assuming Rupee does not sharply appreciate or suddenly consumers want to start paying more for same stuff. If it does -good.)

Free Cash Flow Positive Dreams

Concall 2011- Question: We were looking at 4th Quarter to1st Quarter (2012) next year turning free cash Flow Positive .

Rajeev Dalmia We are not changing any of the guidance or whatever has been said Earlier.

Investopedia defines FCF as – “ It can also be calculated by taking operating cash flow and subtracting capital expenditures. Read more: http://www.investopedia.com/terms/f/freecashflow.asp#ixzz1hAiDnPoo .

Free Cash flow for Dish TV Rs. Crores Over years.

We leave optimistic readers to decide whether the prediction by Mr. Rajeev will hold true that they will become Free Cash Flow Positive in near next two 2 quarters (or will they change definition of Free Cash Flow itself)

Absurd Valuation for a negative earning company

This is where things get tricky and dangerous when anybody sticks his neck out and says something is overvalued or not fairly valued. Current market capitalization for DISH tv is around Rs. 6300 crores . I do not know how to value a consistently loss making company which has lost market share from 75% to 30% in last 5 years and having no clear sight of when it will stop bleeding money .

But I do know that I would NOT like to pay Rs. 6300 crores to buy above company.

Buffet’s investment Criteria (2002 shareholders letter) :

In stocks, we expect every commitment to work out well because we concentrate on

conservatively financed businesses (equity completely wiped off I cannot calculate Debt to Equity ratio )

with strong competitive strengths, (has lost market share from 75% to 30% in last 5-6 years )

run by able and honest people. (Honest Accounting) other biz WWIL and ICL. But for ZEE they have done great .

If we buy into these companies at sensible prices,(markt cap Rs.6300 crores with 4-5 years return -50% and valued with infinite P/E just like dot com days of 1999-00 J you decide )

losses should be rare. (Well if you think you will not have losses think again . )

With yearly Sales of Rs. 1500 crores and Market cap of Rs. 6300 crores (of course it has negative earnings) frankly even dot com boom days seem far away. Price to Sales ratio (moment you hear anyone saying that ideally you should run away) is equal to almost 5. Forget about P/E. Ben Graham would wake up in his grave seeing the “MARGIN of Safety” in this investment.

Even if they make Rs. 100 crores profit (which is almost impossible without accounting gimmickry) the P/E will be “just” around 60 odd. And we have every single analyst saying Dish TV is a buy at these levels. Good Luck. Here is scenario analysis of Future P/E Ratios which to me seem really ambitious to say the least. ( I know I am boring )

|

Possible Net Earnings Rs. Crores and Resultant P/E ratios |

||||

| Market Cap(Rs. Crore) | Net Earnings 1 | Net Earnings 2 | Net Earnings 3 | |

| 2011-12(Currently) |

6300 |

50 |

100 |

150 |

| 2012-13(Probable) |

7000 |

75 |

100 |

150 |

|

Probable P/E Ratio |

2011-12 |

126 |

63 |

42 |

| 2012-13 |

93 |

70 |

47 |

|

I read one analyst report on DISH TV saying its undervalued where they projected revenues for next decade to grow at 17% over next 10 years to convince that one should buy Dish TV . Is this alice in Wonderland or is Dish TV Apple/HDFC/Infy/Phillip Morris/J&J/MSFT/GE(early 80’s and 90’s)/Google ??

Mandatory Digitization – Dish TV gains and Cables Lose??

Mandatory digitization in coming years will force cable operators to go digital way or lose customers to DTH. If people are hoping that cable tv operators will just give back their only source of income and will not provide a set top box to consumers at a discounted price to hold them then they are in for a shock. The cable guys will also fight it out if mandatory digitization makes them lose too many customers. And even if people do leave cable guys why should most of them go to DISH TV ? Brand ? Shahrukh ? VAS ?

Simply because there are lot of people on cable and who may convert to DTH does not mean company will be able to do that profitably enough. Key is “profitably” .

Organized retail is just 5% of Total retail india but just check out how Organized Retail had been bandied around for so many years and look at the returns people have made in last 6-7 years in listed companies.

My critical analysis on Organized Retail: https://amitkumarblog.wordpress.com/2011/09/19/organized-retailing/ should be an eye opener of how seemingly apparent and obvious growth in an industry just doesn’t mean either you as an investor or the company itself will make even moderately significant amount money.

Competitors are Fierce and Have lots of Cash to Burn

2011 Dish tv has 30% share while Tata Sky and Airtel both have around 18% each. Both of these are from biggest corporate houses who have enough cash to burn until they get large enough market shares. Simply because they are not listed directly SHOULD not imply that one should invest in Dish TV.

Literally Not much sustainable competitive advantage as Competitors can and are cutting on Prices leaving Dish TV losing market share

The business is such that literally anyone who has a lot of cash to burn can jump in and make a big dent in the market share as it has been seen for last 6 years where from peak of 75% market share to 30% market share of Dish TV resulted because there isn’t much sustainable competitive advantage . A business should be such that other guys even if they burn cash just cannot take away too much of market share from you and not make you bleed but perform profitably enough. Just think of Colgate , ITC , HDFC , RIL , Titan, Gillette , McDonalds,Coke , Pepsi, Apple, etc . No matter how cheap a toothpaste/cigarette/razor/burger I provide customers just will NOT shift from these companies. It will never happen that within 4-5 years the market share of any of these great businesses drops by 60% or so.

A business where customers won’t shift easily is the one which has a moat around it as Buffet would say . The company DISH TV may not be able to increase the moat at all because its not something which is not penetrable . On top of that it is valued at Rs. 6300 crores with Price to Sales of “just” around 4 or 5 .

The Whole industry can never be a high profit/high return business –Why ? Ask the Content Producers

There is a reason why Dish or for that matter any satellite TV guy will never be really profitable as the strings of its profits are partly held by the content making companies ie TV channels.

Brilliant articles on content providers being the king.

Read this http://online.wsj.com/article/SB10001424052970204879004577110830967627616.html

http://www.businessweek.com/magazine/content/10_12/b4171038593210.htm

http://abovethecrowd.com/2010/04/28/affiliate-fees-make-the-world-go-round/

The SONYs , Colors, ESPN, et al look at what profit the DTH companies are making and they will raise their prices to make sure that the not much money flows to Dish TV .The moment these guys see DISH TV is making a bit more than it actually should the content guys will increase their price . The conduit which brings the content has never been really profitable. The power lies with the content guys. Think of Multiplexes. Have they or can they been ever be really really highly profitable? NO. Because if they start to do the Red Chillies and Time Warners of the world will increase their prices to an extent the profit becomes really normal.

http://abovethecrowd.com/2010/04/28/affiliate-fees-make-the-world-go-round/

From the link main crux:

“If you own a cable channel, your goal is to develop one or two key, hit programs, and fill the rest of the linear lineup with very inexpensive content. What programs will be on during the other 23 hours? it really doesn’t matter , because with 1 hit program you can charge per subscriber and almost a 100% gross margin business.

Too many hits drive up costs. This is why you will see more and more hit shows on the less well-known cable channels. “

You wonder someone launched a new channel LifeOK ?? And of course you can try to count how many channels Zee group has(more than 20) and why they will keep on launching even more with aim of just 1 hit program in each . Now you get it.

Same will happen to DISH TV with content producers almost always having more strength while negotiating. Do not think that since DISH has the customers the TV channels are weak and DISH is strong. Its almost always the other way around all over the world.

Being partly Technology based industry things can change Suddenly or Competitors can beat on Technology

Of course by tech I do not mean to say that Dish tv will come up with something which Steve Jobs said during his last days that they have finally cracked how to enter TV market and make things simple. All I say is with such high valuations right now everybody is assuming that none of the competitors can get to some strong differentiator technology which DISH may not get and customers may shift to other companies.

DTH business is NOT like Telecom

In Telecom the once CAPEX is done networks are set the marginal cost for providing service is very very low to point of being almost zero .

DTH business is completely different ball game with content distribution being a recurring expense and programming costs will always be at least around 45% + forever.

Content cost for Dish TV (As in Jan 08 Con call) – If we look at the business model of content distribution internationally, the programming cost runs anywhere between 35% to 45% of the ARPUs and

currently, the costs are running close to 55%-60% which will come down to the

level of 35%-45%.

Concall Q1’08 Arun: Because there is a cost of programming which they have to pay to the programmers or the content providers. So it cannot be like telecom model because in telecom – there is an infrastructure once you have put, there is no running cost.

Why do you think that even after so much of progress in technology why cannot you just go on internet and see for free all TV channels you would want(and let them put ads here and there)? Read above lines that make it clear that coming future also it will be really not possible to watch any channel for free on internet unless you can prove you are a cable/DTHCustomer (give me ads on free channel I am fine but still content providers will NOT do that.)

“Honest” Accounting by Dish TV

(I wonder if any analyst is allowed to write about the “honest” accounting policy of companies like these. I have never come across any of them)

Glaring Facts Mentioned by Auditors almost every single year

Losses of Dish TV more than 50% of Net worth since its existence for last 7 years

Auditor Comments “The accumulated losses of the Company as at March 31, 2007 are more than fifty percent of its net worth. Further, the Company has incurred cash losses during the current financial year as well as in the immediately preceding financial year.”

This statement has been mentioned in years:

- 2006

- 2007

- 2008

- 2009

In 2010 and 2011 the second sentence “Cash Losses in current year …..” is not there.

So much so for tremendous growth .

Interestingly same pattern of auditors’ qualification is seen in Kingfisher Airlines continuously every single year of its existence . Here are my thoughts on the amazing Kingfisher story https://amitkumarblog.wordpress.com/2011/10/18/would-you-invest-in-this-company-indian-bankers-love-it/

Short term funds used for long-term investments- Are Bankers looking at Dish TV’s use of Loans?

Auditor Comments—“On the basis of utilization of funds, which is based on an overall examination of Balance Sheet of the Company and related information as made available to us, we report that short-term fund amounting to

| Year | Amount (Rs.) |

| 2006-07 | 51,626,07 |

| 2007-08 | 2530.09 million |

| 2008-09 | 1732.71 million |

| 2009-10 | Same comment as previous year |

| 2010-11 | 6,828.84 Million |

have been used for long-term investments/ is not used for the purposes it was raised .”

I being a naïve simple person was taught in B-School that this is a cardinal sin of business no matter which business you are in.

“DO not use short term funds to by long term investments.

Bankers always look very carefully when they loan you the money and track whether you are spending it for purpose you had borrowed. If you don’t comply and lie about your borrowings to bankers they will not lend.”

I guess the above real-life example tells and confirms complete disconnect between what you are taught and what happens in life. By the way again if anybody reads Kingfisher Airlines report they will consistently see the above kind of comments by auditors only the amounts will be much much higher . (And in the end Bankers are currently owning around 23% of KFA, I wonder if they will someday own part of Dish TV itself )

Increasing Revenue by willfully recognizing Rentals as revenue in “Certain” Cases

Auditor Comments “the life of the Consumer Premise Equipment(CPE) for the purposes of depreciation has been estimated by the management as five years. However, in certain cases, the onetime advance contributions towards the CPEs in the form of rentals are recognized as revenue over a period of three years, which is not in line with the estimated life of such assets, in terms of AS-19 ‘Leases’, though the impact of which on the financial statements has not been ascertained by the management.” 2011 Annual Report .

Management Reply- The Company is in the process of streamlining the above practices. (is that a joke ??)

So the above point means that as an analyst I should somehow believe what would be the impact on financial statements due to above accounting shenanigans. (Mail me if you find that out)

Magic of Accounting –Impairment of Fixed Assets of Rs. 174 Crores just vanish in thin air instead results in worthless Goodwill of Rs. 23 crore by adjusting Rs. 151 crore against non-existent General Reserve !!!

This is where things really look nice , magical and creative.

Auditor Comments (2011 Annual report)- “providing for diminution in the value of investment transferred, as required by AS 13, in the Profit and Loss Account in the previous year. Had the Company followed the above Standards in the previous year, the loss on impairment of the above fixed assets/ provision for diminution in the value of investments would have been adjusted in the Profit and Loss Account and loss for the previous year and the debit balance in the Profit and Loss Account as at 31 March 2010 would have been higher by ` 1,743,523,943 though not impaired as required by AS 28. Had the Company accounted for the impairment of fixed assets/ goodwill, the loss for the year and the debit balance in the Consolidated Profit and Loss Account at the end of the year would have been higher by ` 1,743,523,943.

The aforesaid loss on impairment of fixed assets has not been recognised even in the current year as a prior period item. Instead, during the current year, on implementation of the Scheme, the Group has adjusted ` 1,511,023,943 directly against the General Reserve in the consolidated financial statements and has recognized a goodwill of ` 232,500,000 which, according to the information and explanations given to us, does not have any future economic benefit.”

If you are confused reading the above statement (as mostly you should be) here is the summary of what actually happened LEGALLY (I never knew so many things are possible in the world legally – Just try to find if any person has been legally punished for bringing down the financial system in 2008 ) .

The company should have lost Rs. 174 crore more in the year had it done normal accounting as there was “impairment of fixed assets” (read it like this- something has become crap on which company had spent loads of cash) .

But instead of increasing losses in already 7 year continuous and consistent loss making spree in Profit and Loss Account by Rs. 174 crore company did something Magical(not Steve Jobs like). In one stroke of LEGALLY passed Scheme of Amalgamation approved by High Court Delhi (moment I read anything with Amalgamation word in relation to companies my brain stops working) the company adjusted Rs. 151 crores to NON-Existing General Reserve (which was ZERO for every YEAR as Generally General reserve arises out of profits of companies but Dish TV is consistent on one thing at least –Making losses) and rest 23 Crores of Goodwill.

No Goodwill Still Management Will

Reality is there is nothing good about goodwill of Rs. 23 crores .

Read the reply from management on its opinion on Goodwill – “The goodwill recognized by ISMSL does not presently have any future economic benefit. However, the Group has not recognized any impairment loss in the consolidated financial statements.” (Everything is legal J )

October 2011 Conference Call – Rajeev Dalmia- If we analyze our results we are already PAT positive this quarter if you remove the effect of forex loss as well as the high amount of commission which is in fact pre-booking of expenses.

(Yes you are PAT positive because you did not reduce your PAT by Rs. 174 crores sir )

For more ‘tips’ on how companies (read how companies cook up the books and try to find out how these companies have been doing- hint-pretty bad) http://www.rediff.com/money/2006/aug/23firms.htm

Buffet 2002 letter Words on Accounting by Companies

“Three suggestions for investors: First, beware of companies displaying weak accounting. If a company still does not expense options, or if its pension assumptions are fanciful, watch out. When managements take the low road in aspects that are visible, it is likely they are following a similar path behind the scenes. There is seldom just one cockroach in the kitchen.”

Trumpeting EBIDTA

Every presentation, annual report and concall the EBIDTA will be mentioned so many times for reasons I cannot fathom. Just pick out any annual report from DISH TV and you will notice. Its not wrong to keep on telling EBITDA growth everywhere but well here are some good words from Buffett –

“Trumpeting EBITDA (earnings before interest, taxes, depreciation and amortization) is a particularly pernicious practice. Doing so implies that depreciation is not truly an expense, given that it is a “non-cash” charge. That’s nonsense. In truth, depreciation is a particularly unattractive expense because the cash outlay it represents is paid up front, before the asset acquired has delivered any benefits to the business. Imagine, if you will, that at the beginning of this year a company paid all of its employees for the next ten years of their service (in the way they would lay out cash for a fixed asset to be useful for ten years). In the following nine years, compensation would be a “non-cash” expense – a reduction of a prepaid compensation asset established this year. Would anyone care to argue that the recording of the expense in years two through ten would be simply a bookkeeping formality?

Finally, be suspicious of companies that trumpet earnings projections and growth expectations. Businesses seldom operate in a tranquil, no-surprise environment, and earnings simply don’t advance smoothly (except, of course, in the offering books of investment bankers). Charlie and I not only don’t know today what our businesses will earn next year – we don’t even know what they will earn next quarter.”

–2000 annual report — References to EBITDA make us shudder does management think the tooth fairy pays for capital expenditures?

By the way someone please find out EBITDA mention in Colgate’s annual report.

Re-pricing of Options Granted from Rs. 75.2 to Rs. 37.55 (2008-09 Annual Report)

Well what to say about it. Almost everybody does it so why shouldn’t they. I mean even Google did it.

http://www.rationalwalk.com/?p=4168 , http://articles.businessinsider.com/2009-03-11/tech/30056046_1_google-employees-google-stock-repricing

Heads I win, tails you lose.

Debunking the Qualitative Based investment argument

Annual Report 2010-11 – As consumers are forced to evaluate digital viewing options, the majority are likely to choose DTH over cable due to inherent advantages of Value Added Services(debunked here), HD(debunked here), better picture and sound quality( I agree but why only DISH and not competitors), choice of channels(Debunked here), flexibility of payment(debunked here) and movie on demand(debunked here)d amongst others.

Following are the “so called” competitive advantages which Dish tv management and the gung ho analysts keep on repeating in their reports in fact for last 5 years.

Value Added Services

VAS has been used by lot of companies to indirectly imply that customers are fools and they can mint money. Before reading following points I would request to try and find VAS revenues/3G revenue projections during 2005-08 by telecom operators and realize why they have never ever taken off and will never take off as well because India is NOT USA . Same kind of hype is around VAS by DTH operators now .

Movie on demand and Why it can Never be what it is Imagined by Most

It’s apparently a very simple and cost effective way to watch movies in comfort of your home with all benefits and almost no negatives. Anybody can list its benefits and I won’t repeat them here. Its like you spend Rs.50 odd and watch a movie which is available at your convenience in your home.

Unfortunately that does not mean that Dish TV will be able to make substantial amount of money by this Movie on Demand .

- Any point of time the movies option are mostly the ones which are less popular and nobody wants to see so why will they pay to see . (Just check any day the offerings and surely you would be disappointed)

- If the movie is a big hit like Bodyguard or Dabang and it comes for Movie on Demand its almost a certainity that it would have come on normal TV channels earlier or would just within weeks will come on TV (I agree its with ads and a time you may not be convenient for you.) Just check out lately how the biggest of hits are coming on TV quicker than they earlier used to come. Believe me people are not going to pay for something which they are almost sure to get with just “minor”(subjective but see reality with how much revenue they are making) difficulty.

- Someone please tell me one movie(which is popular/hit) on Movie on Demand on Dish TV which has NOT come before on normal channels or within at least 1-2 weeks of it coming on DISH. You would be surprised that you cannot find even a single one.

- Do not underestimate the power of Piracy in India ( I am not supporting by saying this) . If someone really wants to watch a movie and save money in going to theatres he goes to nearby DVD/CD store and gets/rents/buys a pirated DVD/CD and watches it in 1st week of a big blockbuster release (like Khan movies) . Of course quality is bad, its illegal but so what just look at how much pirated stuff is being sold on streets of Mumbai and India. And if anybody is feeling positive let me tell you that it CANNOT be STOPPED/Curtailed no matter what you do . (There is a law in India that says cigarette smoking in public places like roads is banned and someone will have to pay fine .Nice joke isn’t it ?? J )

- DISH TV can never get hold of the blockbuster releases in time like within 2 weeks of theatre release to really entice consumers to buy movie because it is at mercy of Movie producers. Producers want to make maximum amount of money through theatre hence they will NEVER ever release a movie which became a hit quickly on DTH because they will lose some audience from theatres. Only those producers will release movies on DTH quickly are the ones which are anyway not in demand in theatres at all . This directly means only less popular movies which nobody wants to see comes quickly on DISH TV and hence no one(or very less) indeed will see it . Anybody wants to do research on this find out when did Bodyguard or 3 Idiots actually came on Dish TV after their theatrical release or ask when will Don 2 come on Dish TV).

- I could NOT find out how much money they are making by Movie on Demand but it was 1% in June 2008. I am sure it will NOT be substantial amount of revenues else they would have mentioned it in Con-calls or Annual Report.

- Just to add movie pricings are still same after almost 3-4 years.

Games as VAS – As pathetic as they can be

Well what to say about dream of somebody that people are going to pay to play games on Dish TV . I have seen it and tried to play some free game and believe me I am not a gamer at all. But the experience of playing game on Dish TV is something nobody should even try because it is indescribably BAD and of LOW QUALITY. They were offering RA One games earlier. I would love to know how many people actually played it .

Dish TV just cannot make even a meager amount of money by offering paid games. Period. (Guys at EA, Zynga, PSP, App store game developers are NOT stupid else they would have put up lots of games via Comcast/DirectTV, etc and been making lots of money via TV )

Jobs search as VAS- Really ?

Dish has a tie up with Monster. I mean has there been a single job placement because the person found and applied job through DISH TV?? How many people have actually ever searched for job via DISH TV ??

HD TV Offering and High Margin Myth

The latest “high margin/premium” offering seems to be buzzword and a panacea to make money. Everybody seems to be very happy that somehow a lot of subscribers would shift to magic of HD and start paying up more and ARPU will jump. The implicit assumptions(too many) are :

- A lot of HDTV is going to be bought by a lot of customers

- Most of these customers will buy DISH TV HDTV offering over other competitor’s offerings.

- Even if lot of customers currently is on competitor’s normal set top box once they buy HDTV they will throw that and go with DISH TV.

- A lot of channels will actually shoot their programs and provide a REAL HDTV content

- DISH TV will be able to price the Set TOP box and the per month rental at a higher margin as compared to normal set top box and of course the pricing will be cheaper than rest 5/6 competitors offering .

- The biggest assumption is vast majority of Cable TV providers may not be able to offer HD services .

I will leave readers to mull and think why the first 5 points need not necessarily be true but will concentrate on 6 point that DISH TV has advantage over cable because it can offer HDTV. It is factually wrong that cable TV providers cannot offer HD content.

Back in 2003 in USA – “Advanced new digital cable set-top boxes with built-in high-definition tuners give cable operators their first real chance to sell TV equipment, rather than just TV service, at the retail level. “

http://www.cablelabs.com/news/newsletter/SPECS/MayJun_2003/story6.html This is 2011 and in US millions of cable customers DO enjoy HD content on their TV .

Cable TV in US DOES offer everything which (including HD) satellite TV offers .

(http://www.connectmycable.com/resources/cable-vs-satellite.html)

There is no reason why cable people will NOT offer HD if push comes to shove.

Choice of Channels Vs Cable Operators

Lets face it – Satellite TVs are the worst offenders when it comes to giving customers what they do NOT want. Period. NO DEBATE. Out of the so called 300 channels and services offered I would just want to completely delete more than 70% ie almost 200 channels FOREVER.

Of course the company will not allow you to do that. Of course you have option of choosing Pick By channel and pay outrageous price like 100 per month for TEN CRICKET blah blah .You might as well take a bank loan to use Pick By Channel.

I mean why on earth any south Indian Channel or a Live India News channel be there on my TV??

Trust me even with the most diverse family one can imagine the top most 50-80 channels are MAX which people actually see more than 99% of their time. Rest are all crap for most of the people .

I mean when was the last time you saw Disha TV or DD Bharati or RK news or Haryana News and they have 13 Bangla channels . I mean its complete, utter crap which they count as channels and service.

Now you would say someone would find that useful . Well of course so let them see it . Please spare my TV and let me REMOVE those “choice of CRAP channels” .

This means that it might appear on surface that cable operators can offer only say 70 channels vis-à-vis 300 by DISH TV but if you look carefully cable TV offers the most popular channels . (OF course there will be long tails like I want to watch “Haryana News” channel while living in Kanyakumari )

The Most important thing which cable operators do at least for sports is that they give that channel on which Indian team is playing cricket . (Dish TV also has that offer but of course you have to pay extra for it but not with cable guys they give it free).

Flexibility of Payment- Better than Cable operators – Really ??

Dish TV says you have payment flexibility like per month or advance rental or use credit card. Well my cable guy gives this flexibility – I can stop paying for 1-2 months and still watch TV because I have some financial difficulty or it was say March April and had to pay for my 3 children’s school tution , books and uniform fees . Try doing that with DISH TV and see the fun.

When was the last time almost anybody paid at 1 go for 12 months to cable operator ?

If anyone is thinking about ability to pay by credit card (as a great competitive advantage over cable operators think again) and number of credit card holders in India they need to just look at this graph.

(The number of credit cards in circulation has, declined by 3.3 per cent to 1.76 crore as of October 31, 2011, according to the Reserve Bank data.)

Of course I never have to go and pay but cable operator comes to home and takes money at MY Convenient time and my terms.

Someday Subscriber Acquisition cost and Free Subscription will start coming down

Analysts and management have been hoping that SAC will start to really come down substantially enough , subsidies on set top box will come down , free subscription offers will come down ,marketing expense will come down, etc .

All I would say is to visit the US leader in DTH Directtv site .http://www.directv.com/DTVAPP/new_customer/base_packages.jsp

Even after almost a decade and half of being in biz in US which is the most matured market for DTH in world they have to keep on giving free subscription (for 2-3 months)/or free set top box. So there would be never ending subsidizing by DISH TV on set top box and/or subscription.

Conclusion

With a lot thinking I have put some facts above mostly out of curiosity and because I have time .I strongly believe future is unknowable and I am of “I don’t Know Future” school. So while Investing I demand a margin of safety when all the lofty predictions may not come true.

Anybody who wants to put money in DISH TV or for that matter any stock must ask what is the margin of safety and then proceed if he is convinced there is enough if things do not turn out the way they anticipated.

Aptly put across by Mark Twain “It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so.”

Disclaimer: Please don’t take me seriously enough to do something stupid with your money else you are responsible and NOT me. All disputes arising cannot be resolved in any courts J .And don’t sue me .Please!!

The PDF Link for the above post is Dish TV India Analysis

Really a great post exhaustively researched. Even I wrote about Dish TV’s accounting, valuation and breakeven concerns, but not in a single post like you did

http://financeandcapitalmarkets.blogspot.com/2012/02/each-dishtv-subscriber-worth-rs-8000.html

http://financeandcapitalmarkets.blogspot.com/2011/12/want-to-avoid-writing-down-your-assets.html

http://financeandcapitalmarkets.blogspot.com/2011/12/20months-cash-cost-breakeven-dangers-of.html

About companies that release data in Excel format, examples are

Dr Reddy’s & Bharti Airtel for starters.

One more quarter of Dish TV with 44 crore loss . Its now the lost money in every single quarter for about 6 years now with 24+ quarters each quarter they have lost money. I Do not know any other company which has this great ability to lose quarter for last 5 years in each quarter . Does anyone know about it ?

Dear Mr Amit,

I just came across your blog while searching for some other topics in google and sat by reading the entire analysis. Its just great and just conveys one simple thing— “ALL THAT GLITTERS ISNT GOLD”…. a truly comrehensive and informational article— very correctly understood and explained– want to keep reading such intelligent articles-

Thanks,

Nabin.

Hi there! I could have sworn I’ve visited youhr log before buut after

looking att somme off thee artgicles I realized

it’s neww too me. Anyways, I’m definitely dlighted I foound it and I’ll be book-marking it and

checking back often!